As a freelancer, you enjoy the flexibility of being your own boss, but with that freedom comes the responsibility of managing your finances, including income tax filing. Unlike salaried individuals, freelancers often face challenges while filing taxes. This guide aims to simplify the income tax filing process for freelancers, helping them avoid common mistakes and ensure compliance with tax laws.

Introduction

Freelancers generally handle multiple clients and projects, resulting in varied income streams. This irregular income can make income tax filing a difficult task. Unlike traditional employees, freelancers have to take care of their own accounting, tax payments, deductions, and documentation. The key is to understand your tax obligations, organize your records, and approach income tax filing with clarity and confidence.

Freelancers will be considered as normal individual persons in the Income Tax Act, and tax will be levied as per the slab available for an individual.

Understanding Income Tax for Freelancers

- Tax Obligations for Different Freelance Incomes: Freelancers are required to report all sources of income while filing taxes. Whether you earn from domestic clients, international clients, or through platforms like Upwork and Fiverr, everything is taxable. Payments received in cash, bank transfers, or foreign remittances must be included in your income tax filing.

- Overview of Applicable Tax Rates and Slabs: The tax you pay depends on your total taxable income. Freelancers fall under the individual income tax slabs prescribed by the government. The tax slabs and rates are updated annually in the Union Budget, so it’s essential to stay informed. Proper income tax filing ensures you avoid penalties and remain compliant with the latest tax regulations.

Step-by-Step Guide to Filing Income Tax Returns

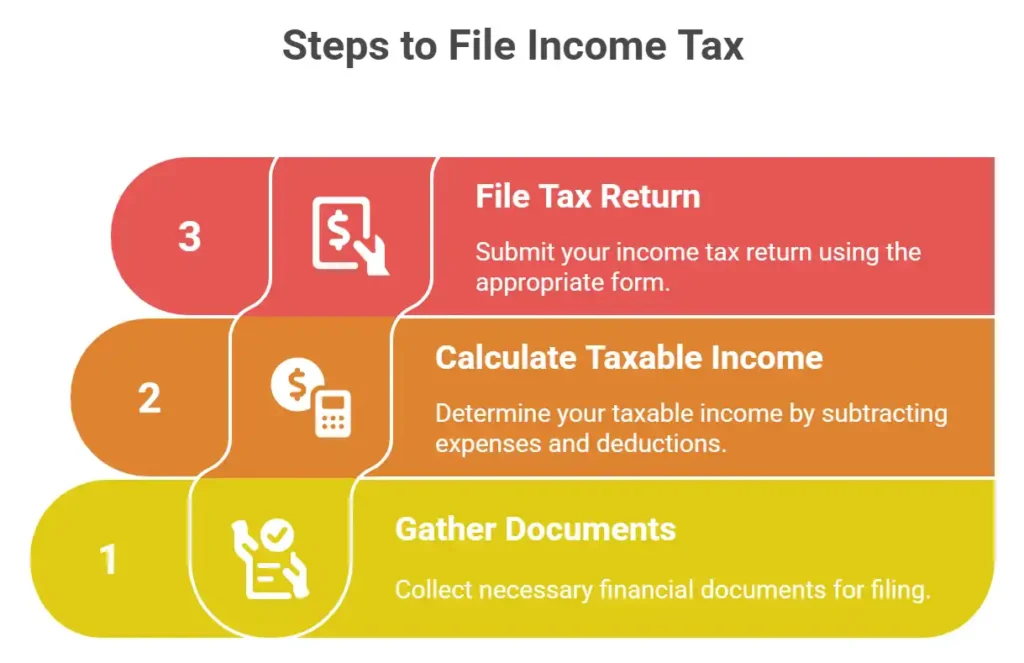

1. Documents Needed for Filing

Accurate income tax filing requires arranging the following documents:

- Bank Statements: Reflecting all payments & receipts.

- Form 26AS: This is your tax credit statement, which shows TDS (Tax Deducted at Source) deducted by clients.

- Invoices and Payment Receipts: To verify your income.

- Expense Proofs: Bills and receipts for expenses like internet bills, software subscriptions, and travel expenses.

- Deduction & Savings Proof: Documents related to LIC, PPF, Mediclaim, Children’s Education Fees, Tax Saving Mutual Funds, Insurance Policies, etc.

- Capital Gain Report: Download the Capital Gain statement from your broker login for all the shares and MF trading made during the year.

2. How to Calculate Taxable Income

- Step 1: Add up all earnings from freelance work during the financial year.

- Step 2: Subtract business expenses such as equipment costs, rent for office space, or utilities.

- Step 3: Deduct tax-saving investments like contributions to PPF, ELSS mutual funds, and health insurance premiums.

The resulting amount is your taxable income, which forms the basis for your income tax filing.

3. Filing Your Income Tax Return

Freelancers typically file their taxes under ITR-3 or ITR-4. If you choose the Presumptive Taxation Scheme (Section 44ADA), you can simplify your income tax filing by declaring 50% of your total income as taxable. The scheme is ideal for freelancers with an annual income of up to ₹50 lakh.

Tax-Saving Tips for Freelancers

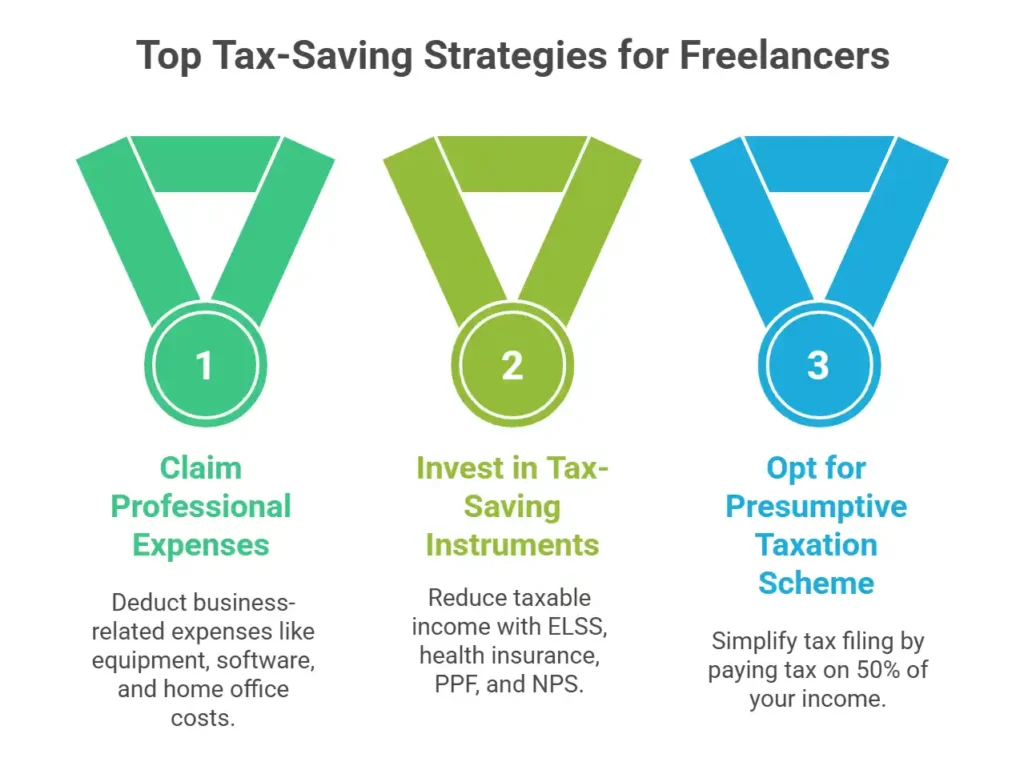

1. Claim Professional Expenses

Freelancers can deduct a wide range of business-related expenses, such as:

- Depreciation on Laptops, printers, and other equipment or assets purchased for work.

- Software subscriptions or tools are essential for your projects.

- Home office expenses, including rent or utility bills, if you work from home.

- Salaries or freelance expenses if taking help from your hired team.

- Travel Expenses spent on their work

- Professional Charges for getting your income tax filing and other compliances.

2. Invest in Tax-Saving Instruments

To reduce your taxable income during income tax filing, consider:

- Investing in tax-saving mutual funds (ELSS) under Section 80C.

- Buying health insurance for yourself and your family under Section 80D.

- Contributing to the Public Provident Fund (PPF) or National Pension Scheme (NPS).

- Take advice from a registered MF Distributor, Munafawaala, for better clarity

3. Opt for the Presumptive Taxation Scheme

If eligible, this scheme simplifies income tax filing by allowing you to pay tax on 50% of your income. It reduces paperwork and eliminates the need to maintain detailed books of accounts.

Common Mistakes to Avoid During Income Tax Filing

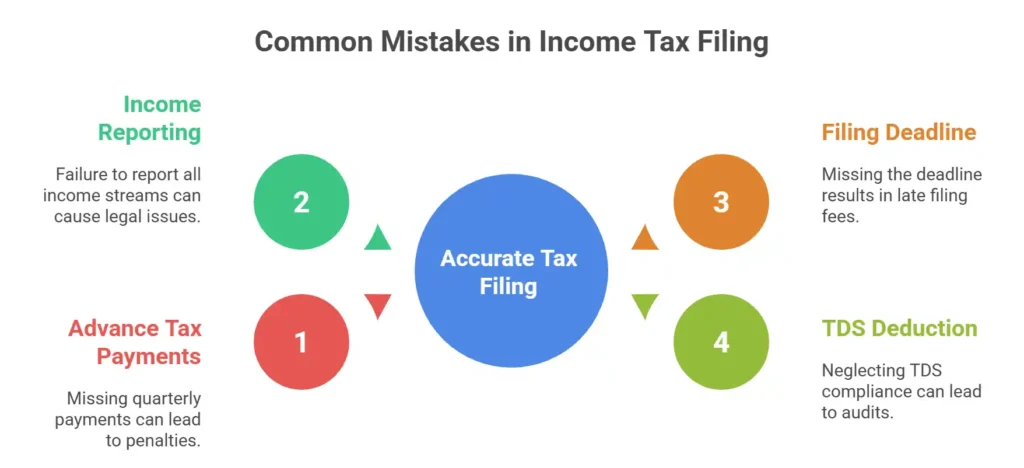

1. Advance Tax Payments

If your total tax liability (after TDS) exceeds ₹10,000 in a year, you are required to pay advance tax in quarterly installments. Missing these payments can result in interest penalties during income tax filing. So, checking TDS quarterly in Form 26AS is necessary to calculate your net tax liability.

2. Not Reporting All Income

Freelancers often forget to include smaller income streams (bank FD interest, Trading in Shares and MF, etc.) or foreign remittances. Ensure that all earnings are reported during income tax filing to avoid legal complications.

3. Missing the Deadline

The deadline for income tax filing is usually July 31st for individuals (if not falling under section 44AB for Audit), including freelancers. Missing this date attracts late filing fees under Section 234F.

4. TDS Deduction

Some freelancers come under audit in Section 44AB due to exceeding the prescribed limit of Turnover, but forget to deduct TDS for all the payments made to their parties. Keeping TDS compliance in check is also crucial for them.

Conclusion

Timely and accurate income tax filing is not just a legal requirement—it’s a sign of good financial discipline. As a freelancer, understanding your tax compliance and staying organized can save you from unnecessary stress and penalties. By following the steps mentioned above, you can streamline your income tax filing process and focus on what you do best- your work.

Remember, proper income tax filing not only ensures compliance but also helps you maximize your deductions and savings. Take the time to review your income, maintain records, and file your returns on time to stay ahead.

Ready to simplify your income tax filing? Visit AMpuesto to get expert assistance and ensure stress-free compliance today!