Introduction

TDS compliance is more than just a legal obligation—it’s a foundation of responsible business practices. Non-compliance with TDS regulations can result in significant penalties, damaging your reputation and financial health.

With businesses handling multiple transactions daily, ensuring accurate TDS deductions, timely payments, and error-free filings is crucial. Income Tax Act, 1961 regulates Tax Deducted at Source and should be deducted before prescribed payments.

In this blog, we’ll cover essential aspects of TDS, its penalties, and how a systematic approach can help you maintain compliance easily. Understanding the TDS penalty rules is vital for avoiding unnecessary financial burdens and staying compliant with the law.

Understanding TDS: A Brief Overview

TDS is a system where the payer deducts a certain amount of money from payments made to the payee. The Income Tax Act specifies the rates and thresholds for such deductions. Once deducted, the TDS amount must be deposited with the Government following the prescribed rules.

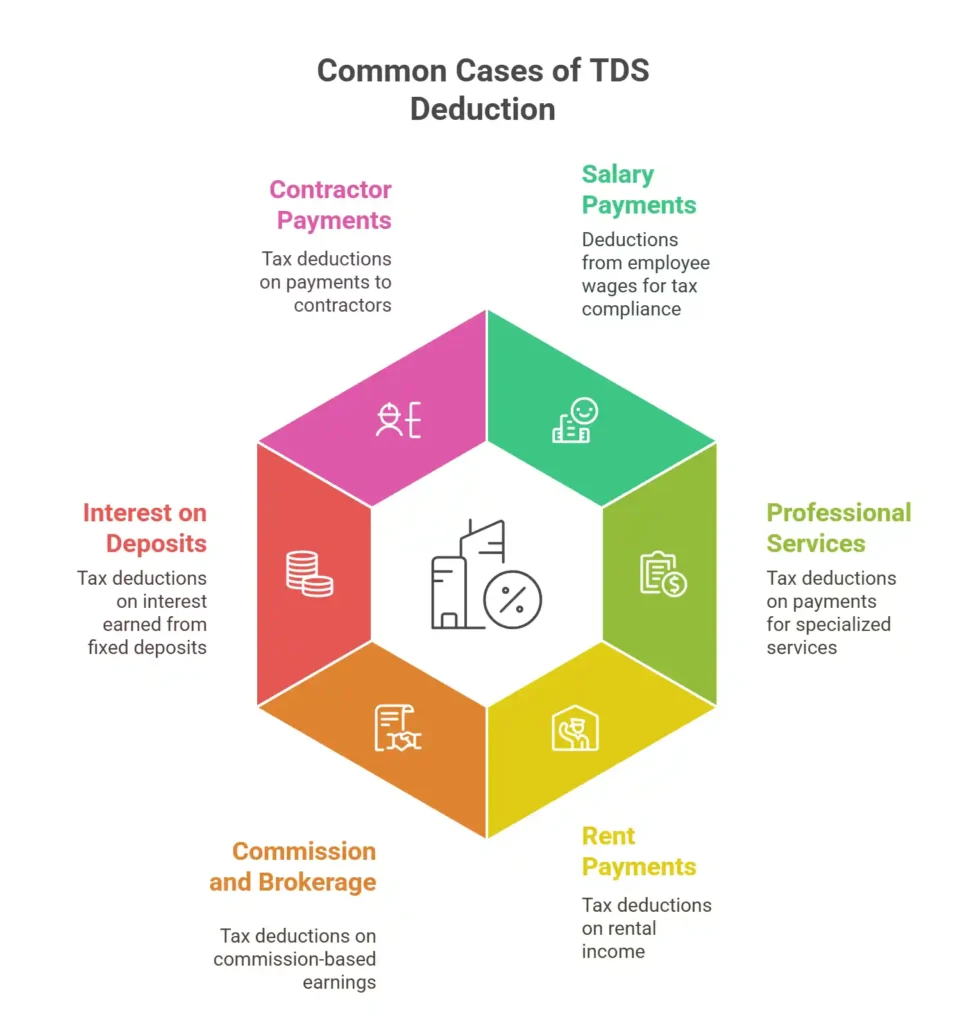

Common Scenarios Where TDS is Applicable

- Payment of salaries

- Payment made for professional or technical services

- Payment of Rent

- Payment Commission and Brokerage

- Interest on Fixed Deposit

- Payment made to Contractors

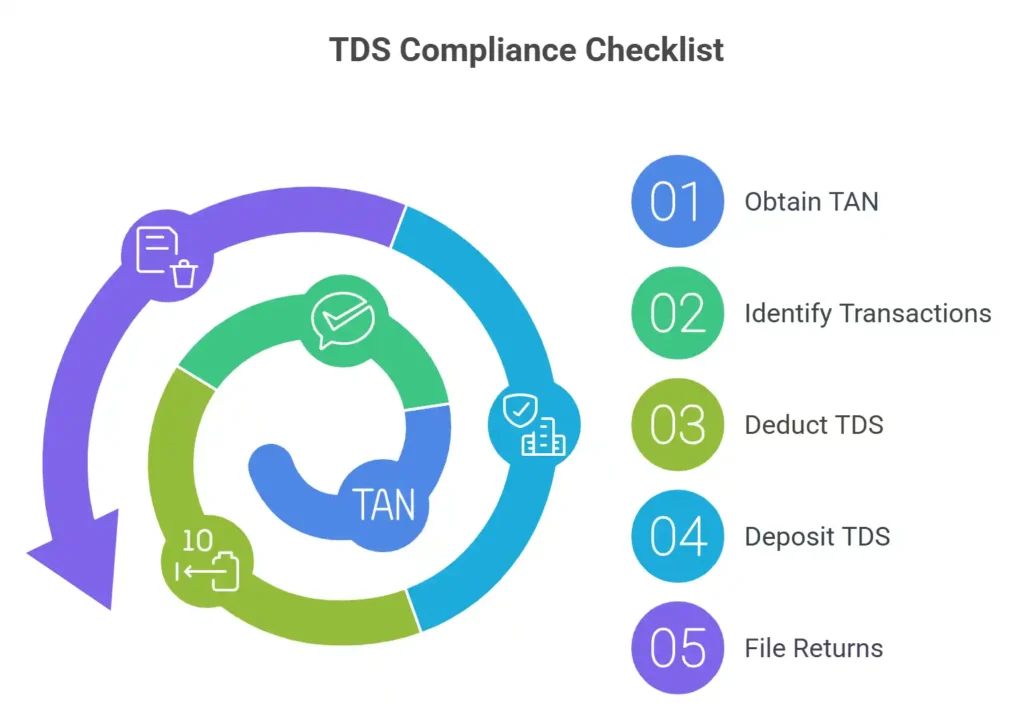

TDS Compliance Checklist

- Obtain a TAN (Tax Deduction Account Number): Having a TAN is mandatory for filing a TDS Return. So before deducting any tax from any payment, the business should apply for TAN (Tax Deduction Account Number)

- Identify Applicable Transactions: Identify the payments which require TDS deductions. Refer to the Income Tax Act’s provisions for applicable rates and thresholds.

- Deduct TDS at Correct Rates: Ensure that deductions are made at the rates specified under the Income Tax Act. Incorrect rates can lead to penalties or additional tax liabilities.

- Deposit TDS Timely: TDS must be deposited to the government’s account by the 7th of the following month and the 30th of the following month ending March 31.

- File Quarterly TDS Returns: File accurate returns using Form 24Q, 26Q, or other applicable forms, depending on the nature of the payment.

Common Due Dates Are:

| Quarter 1 | April to June | 31st July |

| Quarter 2 | July to September | 31st October |

| Quarter 3 | October to December | 31st January |

| Quarter 4 | January to March | 31st May |

6. Issue TDS Certificates: Provide TDS certificates (Form 16/16A) to deductees within the prescribed timelines.

By following this comprehensive TDS compliance checklist, businesses can ensure timely adherence to regulatory requirements and avoid penalties.

TDS Penalties for Non-Compliance

The Income Tax Act specifies penalty provisions for TDS non-compliance. Here are some situations where penalties may apply:

- Late Deduction or Non-Deduction of TDS: Interest of 1% per month or part there of will be levied from the date of TDS is due to be deducted till the amount is deducted.

- Late Deposit of TDS: Interest of 1.5% per month or part there of will be levied from the date of TDS is deducted till the amount is deposited.

- Late Filing of TDS Returns: A penalty of Rs. 200 per day is applicable for delays in filing TDS returns, subject to a maximum of the total TDS amount.

- Incorrect or Non-Filing of Returns: Providing inaccurate information or failing to file returns can attract penalties under Section 271H, ranging from Rs. 10,000 to Rs. 1,00,000.

Understanding the TDS penalty rules is crucial for avoiding these financial setbacks. Adhering to TDS compliance rules ensures smooth business operations.

Best Practices for TDS Compliance

- Use automated software for TDS Returns and Data Management: Use reliable TDS management software that automates calculations, due date reminders, and return filings. It helps reduce errors and ensures timely compliance.

- Audits at regular intervals to avoid errors: Perform regular audits at periodic intervals of TDS records to identify discrepancies and rectify them before filing returns. Audits also help to ensure all transactions requiring TDS deductions are captured.

- Stay Updated with TDS Penalty Rules: Regularly review updates to TDS compliance and penalty rules to ensure your business stays on top of regulatory changes. With AMpuesto, you can be fully updated with all the current rules and regulations.

Conclusion

TDS compliance is a critical responsibility for businesses, directly influencing their financial stability and credibility. By following a structured TDS compliance checklist, understanding penalty provisions, and adopting best practices, businesses can simplify compliance and avoid penalties.

Stay ahead with seamless TDS compliance—choose AMpuesto for accurate filings, timely updates, and peace of mind!