Introduction

If you’re a company director or compliance officer in India, you’ve likely encountered Form AOC-4 and MGT-7/7A during the annual filing season. While these forms may seem complex at first glance, understanding their distinct purposes can simplify your regulatory compliance significantly.

Both forms are mandatory annual filings under the Companies Act, 2013, but they serve different purposes:

- Form AOC-4 submits your company’s financial statements to the Registrar of Companies (ROC)

- Form MGT-7/7A files your annual return with corporate governance details

This guide clarifies when to file each form, what information they require, and how to avoid common compliance pitfalls that could result in penalties.

What is Form AOC-4?

Form AOC-4 is the statutory filing that communicates your company’s financial position to the ROC. Filed under Section 137 of the Companies Act, 2013, this form includes:

- Balance Sheet

- Profit & Loss Account

- Auditor’s Report

- Director’s Report

- Cash Flow Statement (if applicable)

All companies registered under the Companies Act must file AOC-4, regardless of size or turnover. This filing demonstrates that your financial statements are accurate and compliant with accounting standards.

What is Form MGT-7/7A?

Form MGT-7/7A serves as your company’s annual return, a comprehensive snapshot of your corporate structure and governance.

Which form applies to your company?

- MGT-7: Required for all companies except Small Companies and One Person Companies (OPCs)

- MGT-7A: Simplified version for Small Companies and OPCs

This form discloses:

- Director details and changes

- Shareholding patterns

- Details of meetings (Board and General)

- Share transfers and capital structure

- Registered office information

Legal Framework: Understanding Section 137 and Section 92

AOC-4 Legal Basis

Filed under Section 137 of the Companies Act, 2013, Form AOC-4 ensures transparency in financial reporting. The Ministry of Corporate Affairs (MCA) uses this data to:

- Monitor company financial health

- Detect potential fraud or irregularities

- Maintain a central repository of corporate financial data

- Facilitate stakeholder due diligence

MGT-7/7A Legal Basis

Filed under Section 92 of the Companies Act, 2013, this annual return provides regulatory visibility into:

- Ownership and control structures

- Corporate governance practices

- Management composition

- Compliance with statutory requirements

Key Differences: AOC-4 vs MGT-7/7A at a Glance

| Aspect | Form AOC-4 | Form MGT-7/7A |

|---|---|---|

| Legal Provision | Section 137 | Section 92 |

| Purpose | Financial statements filing | Annual return filing |

| Content | Balance sheet, P&L, audit reports | Directors, shareholders, meetings |

| Filing Deadline | 30 days from AGM | 60 days from AGM |

| OPC Timeline | 180 days from FY end | 60 days after 6 months from FY end |

| Late Fee | ₹100/day (max ₹2,00,000) | ₹100/day (no maximum limit) |

| Applicable To | All companies | MGT-7: Most companies; MGT-7A: Small & OPC |

Filing Deadlines: Don’t Miss These Critical Dates

AOC-4 Filing Timeline

For companies with AGM:

- File within 30 days from the AGM date

- Example: If AGM is held on June 30, 2026, AOC-4 must be filed by July 30, 2026

For One Person Companies (no AGM):

- File within 180 days from financial year end

- Example: For FY ending March 31, 2026, file by September 27, 2026

MGT-7/7A Filing Timeline

For companies with AGM:

- File within 60 days from the AGM date

- Example: If AGM is held on June 30, 2026, file by August 29, 2026

For OPCs (filing MGT-7A):

- File within 60 days after 6 months from financial year end

- Example: For FY ending March 31, 2026, file by November 29, 2026

💡 Pro Tip: Mark these deadlines in your compliance calendar immediately after conducting your AGM to avoid last-minute rushes.

Penalties for Late Filing: What You Need to Know

AOC-4 Penalties

Late filing fees:

- ₹100 per day of delay

- Maximum penalty capped at ₹2,00,000

- Applies to both the company and officers in default

Additional consequences:

- Difficulty in securing loans or investors

- Potential disqualification of directors under Section 164

- Legal proceedings under Section 137

MGT-7/7A Penalties

Late filing fees:

- ₹100 per day of delay

- No maximum limit (can accumulate indefinitely)

- Significantly more expensive for prolonged delays

Additional consequences:

- Company may be marked as “non-compliant” in ROC records

- Restricts certain corporate actions (like raising capital)

- Directors may face prosecution

Cost comparison example: A 100-day delay costs ₹10,000 for AOC-4 but also ₹10,000 for MGT-7/7A. However, at 365 days, AOC-4 caps at ₹2,00,000 while MGT-7/7A reaches ₹36,500 and continues rising.

How AOC-4 and MGT-7 Work Together

These forms are interdependent components of your annual compliance cycle:

The Filing Sequence

- Prepare Financial Statements → Financial year closes

- Conduct AGM → Approve financial statements within 6 months

- File AOC-4 → Within 30 days of AGM

- File MGT-7/7A → Within 60 days of AGM

Data Consistency is Critical

Information must match across both forms:

- Share capital figures

- Turnover/revenue numbers

- Director details

- Registered office address

Common issue: If you report different share capital in AOC-4 and MGT-7, the ROC system may flag inconsistencies, leading to queries or rejection.

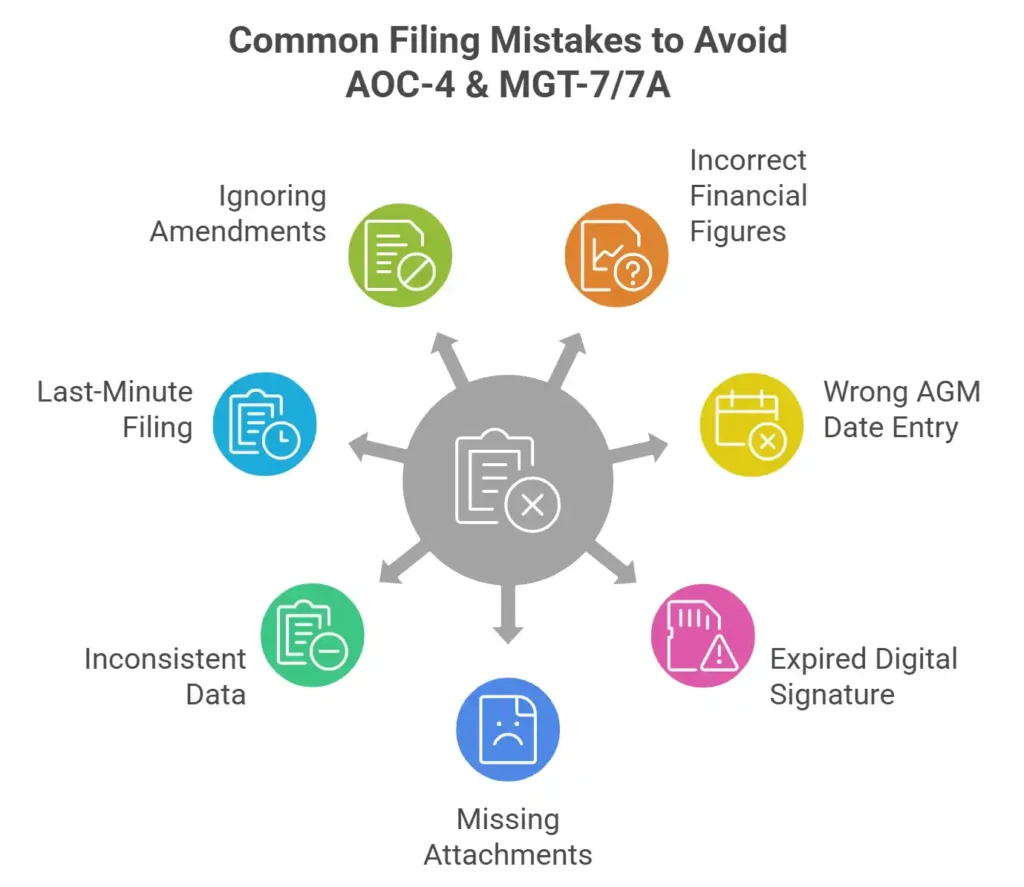

7 Common Filing Mistakes to Avoid

1. Incorrect Financial Figures

Double-check all amounts against audited financials before submission. Even minor discrepancies can trigger ROC queries.

2. Wrong AGM Date Entry

Many filers confuse:

- Date of financial statement approval

- Date of AGM

- Date of signing financial statements

Always use the actual AGM date as your reference point.

3. Expired or Invalid Digital Signature

Ensure your Digital Signature Certificate (DSC) is:

- Valid and not expired

- Registered with the MCA portal

- Class 2 or Class 3 (as required)

4. Missing Mandatory Attachments

For AOC-4:

- Auditor’s Report

- Director’s Report

- Financial statements in XBRL format (if applicable)

For MGT-7/7A:

- List of shareholders

- Photographs of registered office (recent MCA requirement)

5. Inconsistent Data Across Forms

Cross-verify data between AOC-4 and MGT-7 before filing to ensure alignment.

6. Last-Minute Filing

Technical glitches on the MCA portal are common. File at least 2-3 days before the deadline.

7. Ignoring Recent Amendments

Stay updated on MCA circulars and notifications that may change filing requirements.

Recent MCA Updates You Should Know

The Ministry of Corporate Affairs regularly updates compliance requirements. Here are critical changes:

Form AOC-4 Updates

- Mandatory disclosure of detailed Auditor’s Report elements

- Enhanced Director’s Report requirements

- XBRL filing mandatory for certain company classes

Form MGT-7/7A Updates

- Photographic evidence of registered office now mandatory (external building view)

- Enhanced disclosure of related party transactions

- Stricter verification of director KYC details

MCA V3 Portal Changes

The new MCA V3 portal has streamlined many processes but also introduced:

- More stringent document upload requirements

- Enhanced data validation checks

- Integrated payment gateways

Action item: Regularly check the MCA website and subscribe to updates to stay compliant.

Step-by-Step Filing Guide

Filing Form AOC-4

- Prepare documents: Finalize and approve financial statements in AGM

- Log in to MCA portal: Use your company credentials

- Select AOC-4: Navigate to MCA Services > File e-Forms

- Fill mandatory fields: Company details, AGM date, financial data

- Attach documents: Upload financial statements, reports in PDF/XBRL

- Apply DSC: Digitally sign by authorized signatories

- Pay fees: Process payment through MCA portal

- Submit and download: Save acknowledgment for records

Filing Form MGT-7/7A

- Compile information: Gather shareholder list, director details, meeting minutes

- Access MCA portal: Log in with company credentials

- Choose correct form: MGT-7 (regular companies) or MGT-7A (Small/OPC)

- Complete sections: Fill all mandatory fields accurately

- Upload attachments: Include photographs, shareholder list

- Digital signature: Apply DSC of authorized persons

- Process payment: Pay applicable fees

- Submit form: Download acknowledgment receipt

Best Practices for Timely Compliance

Create a Compliance Calendar

- Set reminders 45 days before your AGM

- Schedule internal deadlines 5-7 days before actual due dates

- Assign clear responsibilities to team members

Maintain Digital Records

- Keep scanned copies of all filings

- Store acknowledgment receipts securely

- Maintain a checklist for each filing season

Work with Professionals

Consider engaging:

- Company Secretaries for complex filings

- Chartered Accountants for financial accuracy

- Compliance software for automated reminders

Regular Internal Audits

- Conduct quarterly reviews of compliance status

- Verify director and shareholder data regularly

- Update registered office details promptly

Conclusion: Stay Compliant, Stay Worry-Free

Form AOC-4 and MGT-7/7A are fundamental pillars of corporate compliance in India. While they serve different purposes, financial transparency versus governance disclosure, both are essential for maintaining good standing with the ROC.

Key takeaways:

- AOC-4 focuses on financial statements (30-day deadline from AGM)

- MGT-7/7A captures annual return and governance data (60-day deadline from AGM)

- Penalties for late filing can be substantial, especially for MGT-7/7A

- Data consistency between forms is critical

- Recent MCA updates require enhanced documentation

By understanding these requirements and planning ahead, you can ensure smooth annual compliance without last-minute stress or financial penalties.

FAQs

No, you can’t file MGT-7/7A before filing Form AOC-4 in the MCA Portal. The system requires filing Form AOC-4 first.

You’ll face cumulative penalties for both forms. File as soon as possible and pay the applicable late fees. Consider taking professional help to expedite the process.

Yes, but it requires filing additional forms (AOC-4 XBRL or MGT-14) and may involve additional fees. Prevention through careful review is better than correction.

No. All companies registered under the Companies Act, 2013, including startups, must file both forms annually, regardless of revenue or activity level.

Log in to the MCA portal and check your company master data. Successfully filed forms appear in the “View Public Documents” section within 2-3 business days.