Introduction

Incorporating a Private Limited Company is one of the first and most important legal steps for entrepreneurs in India. It converts a business idea into a recognised legal entity under the Companies Act, 2013 and brings credibility with banks, investors, and regulators.

Although the Ministry of Corporate Affairs (MCA) has made the incorporation process largely online and streamlined, founders still make avoidable mistakes. These errors usually happen due to lack of planning, misunderstanding of legal requirements, or casual handling of documentation. While they may seem minor at the beginning, they often result in delays, resubmissions, penalties, or future compliance issues.

This article focuses on the most common mistakes to avoid while incorporating a Private Limited Company in India, based on practical experience, so founders can start their business on a solid and compliant foundation.

Brief Overview of the Private Limited Company Incorporation Process

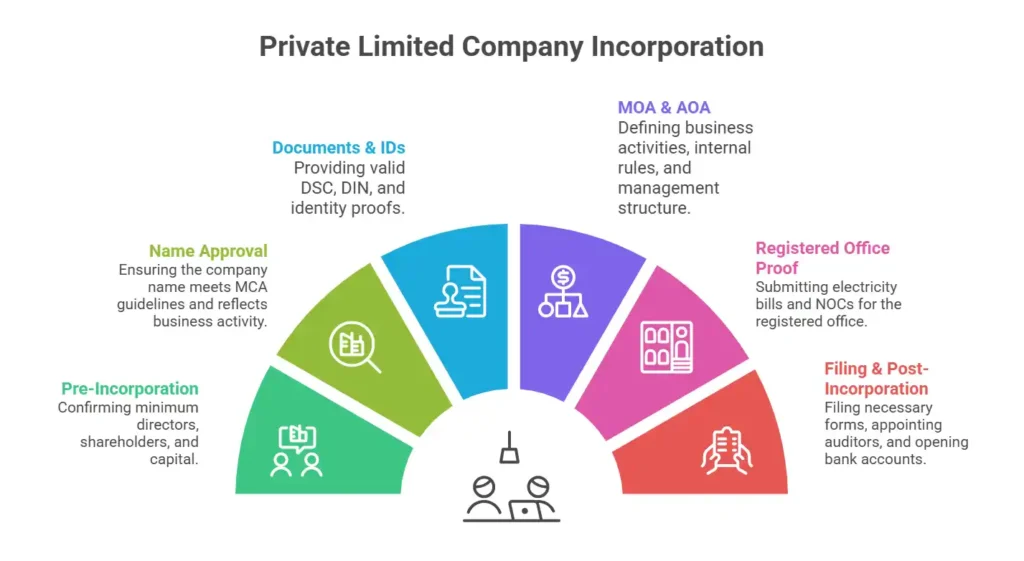

Before discussing mistakes, it is important to understand the basic incorporation flow:

- Minimum 2 directors and 2 shareholders

- At least one director must be a resident of India

- Name reservation through SPICe+ Part A

- Obtaining Digital Signature Certificate (DSC) and Director Identification Number (DIN)

- Drafting Memorandum of Association (MOA) and Articles of Association (AOA)

- Filing SPICe+ Part B, INC-9, and AGILE-PRO forms

Each step involves legal and technical accuracy. Even a small mistake at any stage can delay incorporation or create long-term implications.

8 Common Mistakes to Avoid During Private Limited Company Incorporation

1. Choosing an Incorrect or Non-Compliant Company Name

One of the most frequent reasons for delay in incorporation is rejection of the proposed company name.

Common mistakes include:

- Selecting a name similar to existing companies or trademarks

- Using restricted or regulated words without prior approval

- Choosing a name that does not reflect the company’s business activity

Name approval is done through SPICe+ Part A and is valid for a limited period. Rejection leads to loss of time and additional filing fees.

Practical insight:

Many founders underestimate this step. Without a reserved name, the incorporation process cannot move forward. Checking MCA guidelines and trademark availability before applying is critical.

2. Drafting an Incorrect or Narrow Object Clause in MOA

The object clause in the Memorandum of Association defines what activities the company is legally allowed to carry out.

Mistakes commonly seen:

- Drafting very short or vague object clauses

- Using unclear or unreadable descriptions of business activities

- Not accounting for future expansion or allied activities

If a business activity is not covered in the MOA, the company may face legal restrictions later. Altering the MOA after incorporation involves additional approvals, compliance, and costs.

3. Improper Shareholding and Founder Structure

Many founders finalise shareholding percentages casually at the time of incorporation, without considering long-term impact.

Common errors:

- Equal shareholding without a decision

- Making framework

- Ignoring future investors and equity dilution

- Not understanding voting rights and control

An improper shareholding structure often leads to founder disputes and difficulties during fundraising. Planning this structure carefully at incorporation stage saves significant trouble later.

4. Ignoring DIN and DSC Accuracy

Every director must have a valid DIN and DSC for incorporation.

Mistakes include:

- Using expired DSCs

- Incorrect personal details in DIN applications

- Mismatch between PAN, Aadhaar, and MCA records

Such errors result in rejection of incorporation forms and unnecessary delays.

5. Errors in Incorporation Documents and Declarations

Accuracy in documents is critical during company incorporation.

Typical mistakes:

- Spelling errors in names of directors or subscribers

- Mismatch in address details

- Incorrect PAN or identity proofs

- Improperly signed or incomplete documents

These issues not only delay incorporation but can also cause problems during audits, funding rounds, and future ROC filings.

6. Mistakes Related to Registered Office Proof (Electricity Bill & NOC)

One of the most common and avoidable mistakes relates to registered office documentation.

Key issues observed:

- Submission of outdated electricity bills (older than 2 months)

- Unclear or unreadable address proof

- Missing or incorrectly drafted No Objection Certificate (NOC)

When the premises are not owned by the company, a valid NOC from the owner is mandatory. Incorrect or missing documents often lead to resubmission requests from MCA.

Real-life example: In one case, an outdated electricity bill was submitted with SPICe+ Part B, leading to rejection and refiling of all forms, causing a delay of several days.

7. Poor Planning of Authorised and Paid-Up Capital

Although there is no minimum capital requirement, poor planning of capital structure is a frequent issue.

Common mistakes:

- Frequent capital alterations after incorporation

- Setting authorised capital too low without future planning

- Selecting capital amounts without aligning with business needs

This results in repeated filings and unnecessary government fees.

8. Ignoring Post-Incorporation Compliance Requirements

Incorporation is only the starting point. Many companies fail to comply with mandatory post-incorporation requirements.

Often ignored compliances include:

- Appointment of first auditor (ADT-1)

- Opening of company bank account

- Filing commencement of business

- Maintaining statutory registers and records

Non-compliance at this stage may lead to penalties and even disqualification of directors.

Why These Mistakes Can Be Costly

Mistakes made during incorporation may not show immediate impact, but can lead to:

- Legal disputes among founders

- Difficulty in raising funds

- MCA notices and penalties

- Loss of credibility with banks and investors

Correcting these issues later often costs significantly more than doing it right at the beginning.

How to Avoid These Mistakes

- Plan the business structure and shareholding carefully

- Ensure accuracy in documentation and disclosures

- Draft MOA and AOA with a future-oriented vision

- Strictly follow MCA guidelines

- Seek professional assistance for incorporation and compliance

A well-structured incorporation process supports smoother operations and long-term growth.

Incorporation Checklist (Quick Reference)

Use this checklist before filing incorporation forms to avoid rejection and delays:

1. Pre-Incorporation

- Confirm minimum 2 directors and 2 shareholders

- Ensure at least one director is a resident of India

- Finalise shareholding and voting structure

- Decide authorised and paid-up capital with future planning

2. Name Approval

- Check MCA naming guidelines

- Conduct trademark search

- Ensure name reflects business activity

- Apply through SPICe+ Part A

3. Documents & IDs

- Valid DSC for all directors and subscribers

- Correct DIN details matching PAN and Aadhaar

- Accurate identity and address proofs

4. MOA & AOA

- Clearly defined main business activities

- Object clause covers future expansion

- Proper internal rules and management structure

5. Registered Office Proof

- Electricity bill not older than 2 months

- Clear and readable address proof

- Properly drafted NOC (if premises not owned)

6. Filing & Post-Incorporation

- File SPICe+ Part B, INC-9, and AGILE-PRO

- Appoint first auditor (ADT-1)

- Open company bank account

- File commencement of business

Conclusion

Incorporating a Private Limited Company is a critical milestone for entrepreneurs. While the process is online and simplified, it demands careful planning, legal understanding, and attention to detail.

By avoiding the common mistakes discussed above, founders can ensure smoother private limited company incorporation and avoid future compliance challenges. Starting right is always easier and less expensive than fixing issues later.

FAQs

The most common mistake is choosing a non-compliant or similar company name, leading to rejection of SPICe+ Part A.

Yes. Even after name approval, errors in documents, MOA, DSC, DIN, or registered office proof can result in rejection or resubmission.

The object clause defines what activities a company can legally perform. Activities not mentioned may require MOA alteration later.

Yes, if the premises are not owned by the company, a valid NOC from the owner is mandatory.

Generally, the electricity bill should not be older than 2 months at the time of filing.

Ignoring post-incorporation compliances can result in penalties, MCA notices, and possible director disqualification.