Every company registered under the Registrar of Companies (RoC) is required to appoint an auditor. The appointed auditor must be a Chartered Accountant, qualified under “The Institute of Chartered Accountants of India Act, 1949.” Form ADT-1 plays a crucial role in this process, as it serves as a regulatory compliance document that every company must file with the RoC upon appointing an auditor.

Purpose of Form ADT-1

Form ADT-1 is mandated by the Companies Act, 2013, specifically under Sections 139 and 140. The form is used to officially notify the RoC that a company has appointed an auditor. Simply appointing an auditor and maintaining internal records isn’t sufficient. Since this information is public, companies must formally submit it via ADT-1 to ensure transparency and compliance.

Filing Deadline for ADT-1

ADT-1 must be filed within 15 days of the Annual General Meeting (AGM) where the auditor is appointed. Timely filing is crucial, as it ensures the company remains compliant with the law and avoids unnecessary penalties.

ADT-1: Legal Governance

The form is governed under Sections 139 and 140 of the Companies Act, 2013. These sections outline the regulations for the appointment, reappointment, and removal of auditors. By making it a requirement to file Form ADT-1, the Companies Act ensures that the appointment of auditors is a matter of public record and can be accessed for verification purposes.

Why Filing ADT-1 is Important

When a company appoints an auditor, simply maintaining internal documents regarding the appointment is not enough. The RoC must be informed of the auditor’s appointment because it becomes part of the company’s public records. Filing ADT-1 is a legal obligation that companies must fulfill to ensure compliance and transparency with government regulations.

Fees for Filing ADT-1

The fees for filing Form ADT-1 depend on the share capital value of the company. Below is the fee structure as per the provided details:

This structured fee is important for companies to be aware of, as the amount varies depending on the authorized share capital of the business, ensuring they pay the correct amount when filing Form ADT-1.

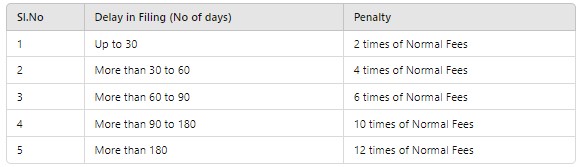

Penalties for Non-Filing of ADT-1

The penalties for non-filing of Form ADT-1 are based on the delay in filing. The longer the delay, the higher the penalty, which is calculated as a multiple of the normal fees. Below is the breakdown of penalties based on the number of days the filing is delayed:

This table shows how quickly the penalty increases with the number of days the filing is delayed. Companies are encouraged to file ADT-1 on time to avoid these escalating penalties.

Conclusion

Form ADT-1 is an essential regulatory compliance document for companies registered under the RoC. It ensures that the public is informed of a company’s auditor appointment and that the company complies with the law. By filing this form within 15 days of the AGM and adhering to Sections 139 and 140 of the Companies Act, 2013, companies can avoid penalties and ensure transparency in their financial operations.