Introduction

MGT-7 and MGT-7A are crucial annual return forms that every company incorporated under the Companies Act, 2013, must file to maintain compliance with Indian corporate law. These forms capture key information about the company’s financial health, management structure, and shareholder details. While MGT-7 is the standard form for most companies, MGT-7A is specifically designed for small companies and One Person Companies (OPCs).

Filing these forms accurately and on time is essential to ensure that a company remains in good legal standing and avoids penalties. In this blog, we’ll delve into the specifics of MGT-7 and MGT-7A, covering their importance, the filing process, and the consequences of non-compliance.

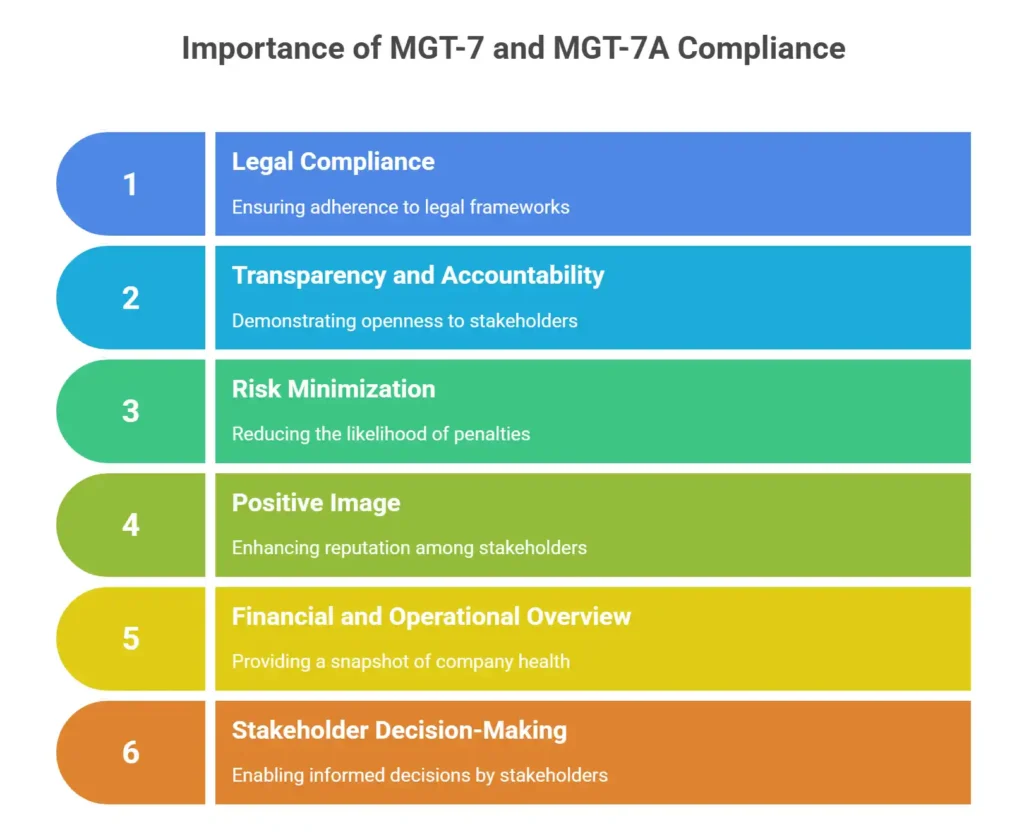

Importance of MGT-7 and 7A

Legal Compliance: MGT-7 and MGT-7A play a crucial role in ensuring that a company adheres to the legal frameworks set out by the Companies Act, 2013. Filing these annual returns is not just a statutory obligation but a demonstration of the company’s transparency and accountability to its stakeholders.

By complying with these requirements, a company minimizes the risk of penalties and legal actions that may arise from non-compliance. The accuracy and timely submission of these forms signal the company’s commitment to regulatory standards, promoting a positive image in the eyes of investors, regulatory bodies, and the public.

Overview of Financial and Operational Details: MGT-7 and MGT-7A also provide a comprehensive snapshot of a company’s financial and operational health. These forms contain essential details such as the company’s shareholding pattern, indebtedness, and key financial metrics, allowing stakeholders to assess the company’s performance and growth trajectory.

Additionally, they provide insight into the company’s governance structure, ensuring that the organization is being managed in accordance with its Memorandum and Articles of Association.

By offering a clear picture of the company’s financial standing and operational efficiency, MGT-7 and MGT-7A serve as vital tools for investors, creditors, and regulatory authorities to make informed decisions.

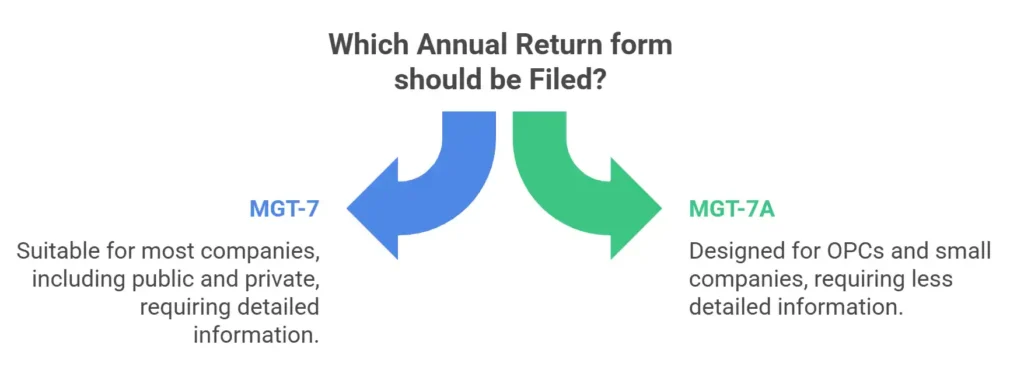

Difference Between MGT-7 & 7A

MGT-7 and MGT-7A are annual return forms that companies in India need to file with the Registrar of Companies (RoC) as per the Companies Act, 2013. MGT-7 is used by most companies, including public and private companies, to report details like shareholders, directors, financial information, and other key company data. On the other hand, MGT-7A is a simplified version of the form, specifically designed for One Person Companies (OPCs) and small companies.

The key difference between the two forms is that MGT-7A requires less detailed information, making it easier for smaller entities to comply with the annual return requirements. This distinction helps to reduce the compliance burden on smaller businesses, while still ensuring that all necessary information is reported to the authorities.

What is the Time Period for filing MGT-7 or 7A?

The timeline for filing MGT-7 and MGT-7A is crucial for companies to ensure compliance with the Companies Act, 2013. Both forms, MGT-7 (for all companies except OPCs and small companies) and MGT-7A (for OPCs and small companies), must be filed within 60 days from the date of the Annual General Meeting (AGM).

This 60-day period allows companies to accumulate and verify all necessary details, ensuring accurate and comprehensive reporting of the company’s financials and other statutory information for that financial year. Failing to adhere to this deadline can result in penalties and additional compliance burdens.

Is MGT-7 compulsory for all Companies?

Yes, this form is compulsory for all Companies registered under the Companies Act. Every Company must file this form irrespective of its size and type, which is registered under the Companies Act.

What is the Turnover limit for MGT 7 or 7A?

The filing of MGT-7 or MGT-7A, which are annual return forms under the Companies Act, 2013, depends on the turnover and the type of company. MGT-7 is required for all companies except small companies and One Person Companies (OPCs). MGT-7A, on the other hand, is specifically for small companies and OPCs.

A small company is defined by its turnover, which should not exceed ₹20 crores as per the latest amendment. If a company’s turnover exceeds this limit, it must file the MGT-7 form. For companies within this turnover threshold, MGT-7A is the appropriate form. Proper compliance ensures that companies meet their statutory obligations and avoid penalties.

What are the Late Filing Fees for MGT-7 or 7A?

The late filing fees for MGT-7 or MGT-7A can be a significant burden for companies that miss the due date. The fee structure is designed to encourage timely compliance and is calculated based on the number of days the filing is delayed.

Currently, the penalty is ₹100 per day for both MGT-7 and MGT-7A, with no upper cap, meaning the longer the delay, the higher the cost. This can quickly add up, leading to substantial penalties, especially for companies that are significantly overdue. Therefore, it’s crucial for companies to ensure that they meet their filing deadlines to avoid these escalating fees.

Conclusion

In conclusion, the timely and accurate filing of MGT-7 and MGT-7A is essential for maintaining legal compliance and fostering transparency within a company. These annual returns not only ensure adherence to the regulatory framework of the Companies Act but also provide a detailed overview of the company’s financial and operational health.

By submitting these forms on time, businesses can avoid penalties, enhance their credibility, and build trust with stakeholders. Therefore, filing MGT-7 or MGT-7A should be treated as a priority to safeguard the company’s reputation and ensure long-term sustainability.