In today’s fast-paced business landscape, startups in India are constantly striving to make their mark. The role of a Chief Financial Officer (CFO) is pivotal in ensuring the financial health and success of any organization. However, hiring a full-time CFO can be a significant financial burden for startups. This is where Virtual CFO services come into play. In this article, we will explore the concept of Virtual CFO services in India and how they are transforming the financial management landscape for startups.

Introduction

Startups in India face a unique set of challenges when it comes to managing their finances. Limited budgets, uncertain revenue streams, and the need for expert financial advice make the role of a CFO indispensable. However, hiring a full-time CFO can be prohibitively expensive for startups, especially in their early stages. This is where Virtual CFO services step in to bridge the gap.

Understanding Virtual CFO Services

Virtual CFO services are essentially outsourced financial management solutions tailored to meet the specific needs of startups and small businesses. These services provide access to experienced financial professionals who work remotely to manage all aspects of a company’s finances.

Benefits of Virtual CFO Services for Startups

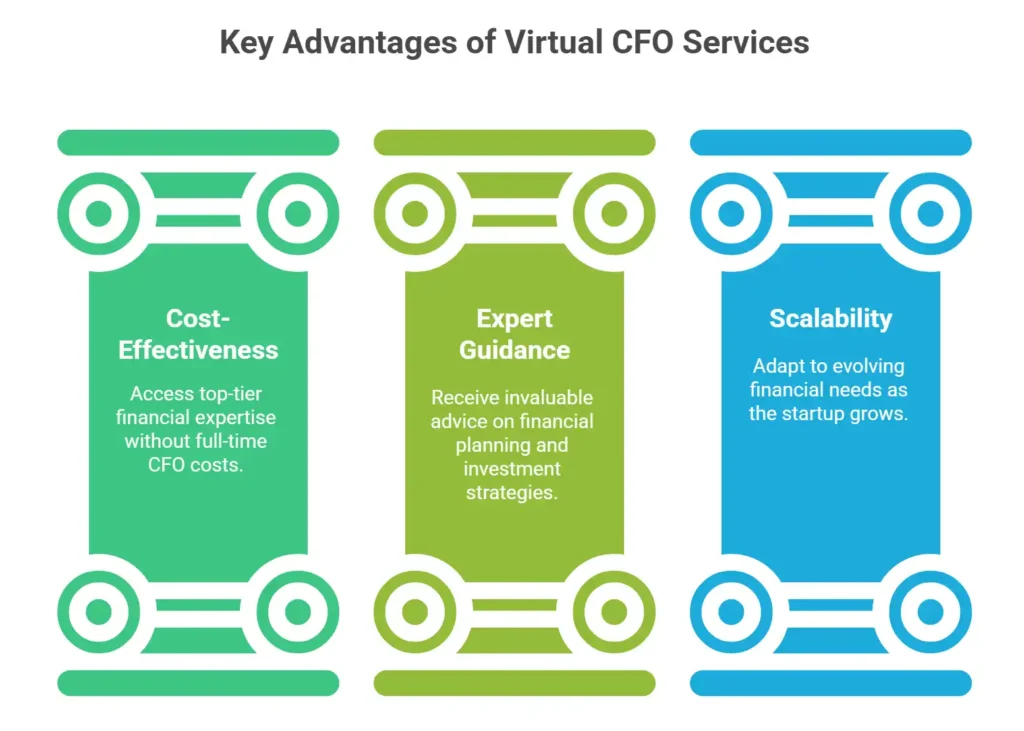

1. Cost-Effective Financial Management

One of the primary advantages of virtual CFO services is cost-effectiveness. Startups can access top-tier financial expertise without the hefty price tag associated with hiring a full-time CFO. This allows them to allocate their limited resources to other critical areas of their business.

2. Expert Financial Guidance

A virtual CFO can offer a plethora of financial expertise and information. They can offer invaluable guidance on financial planning, budgeting, and investment strategies, helping startups make informed decisions that drive growth.

3. Scalability and Flexibility

Virtual CFO services are highly scalable. As a startup grows, the CFO’s role can evolve to meet changing needs. Whether it’s raising capital, managing mergers and acquisitions, or optimizing cash flow, virtual CFOs can adapt to the evolving financial landscape.

How Virtual CFO Services Work

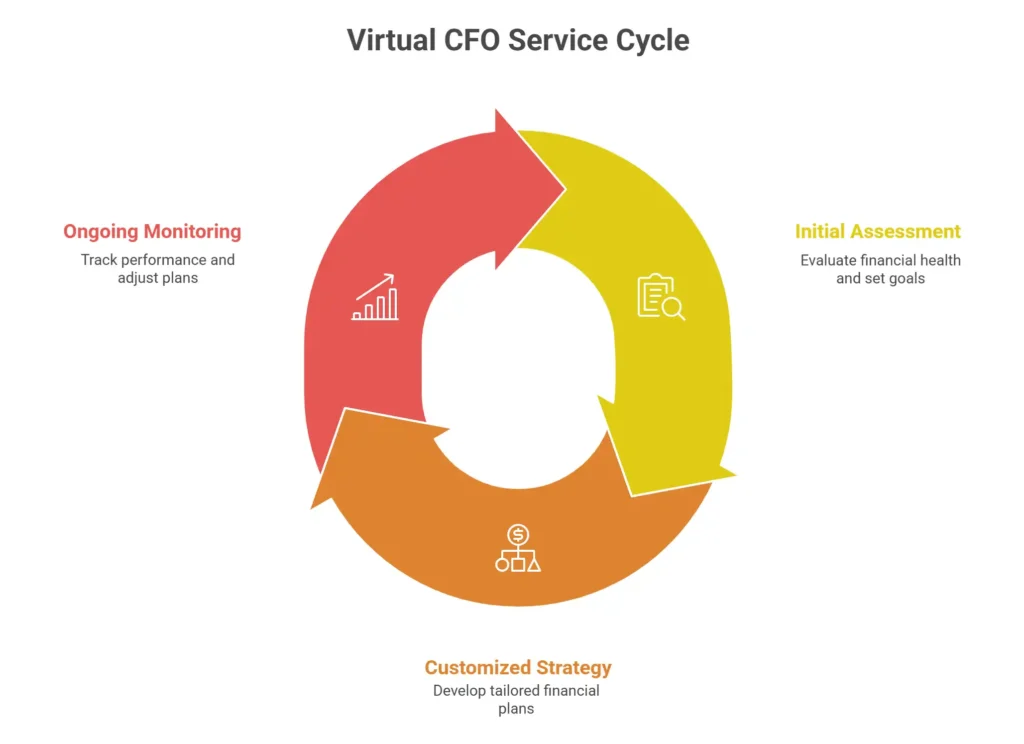

1. Initial Assessment

The journey typically begins with a thorough assessment of the startup’s financial health. This involves analyzing existing financial records, identifying pain points, and setting clear financial goals.

2. Customized Financial Strategy

Once the assessment is complete, the virtual CFO designs a customized financial strategy tailored to the startup’s objectives. This strategy encompasses everything from cash flow management to risk mitigation.

3. Ongoing Financial Monitoring

The virtual CFO continuously monitors the startup’s financial performance, making real-time adjustments as needed. This proactive approach ensures that the company stays on track towards its financial goals.

Choosing the Right Virtual CFO Service Provider

Selecting the right virtual CFO Service provider is crucial. Startups should look for firms with a proven track record, expertise in their industry, and a commitment to their success.

Common Misconceptions About Virtual CFO Services

There are several misconceptions surrounding virtual CFO services, such as them being suitable only for large corporations. In reality, these services are highly adaptable and beneficial for startups of all sizes.

Conclusion

In conclusion, virtual CFO services have emerged as a game-changer for startups in India. They provide cost-effective access to top-notch financial expertise, enabling startups to make informed financial decisions and achieve sustainable growth. As the business landscape continues to evolve, virtual CFO services will likely play an increasingly pivotal role in shaping the financial success of startups.

FAQs About Virtual CFO Services

1. What exactly is a Virtual CFO?

A Virtual CFO is a financial professional who provides remote financial management and advisory services to businesses, particularly startups and small businesses.

2. How do Virtual CFO services differ from traditional CFOs?

Virtual CFO services are outsourced, cost-effective solutions, whereas traditional CFOs are full-time employees of a company. Virtual CFOs offer flexibility and scalability.

3. Are Virtual CFO services suitable for all types of startups?

Yes, Virtual CFO services can be tailored to meet the specific needs of startups across various industries and sizes.

4. How can I find the right Virtual CFO service provider for my startup?

Start by researching providers with a strong track record, industry expertise, and a commitment to client success. Request references and assess their ability to align with your startup’s goals.

5. What are the key financial areas that Virtual CFOs can help startups with?

Virtual CFOs can assist with financial planning, budgeting, cash flow management, risk mitigation, and strategic financial decision-making.