Overview

The Goods and Services Tax (GST), introduced in July 2017, revolutionized India’s tax system by consolidating multiple indirect taxes into a single, unified framework. Its primary objectives are to streamline GST compliance and enhance transparency across the corporate ecosystem. For businesses operating within this structure, understanding and adhering to GST regulations is critical.

Compliance with GST laws not only ensures smooth business operations but also strengthens relationships with tax authorities while mitigating the risk of penalties and legal complications. This platform offers a comprehensive checklist to help businesses establish and maintain effective GST compliance.

Comprehending GST Compliance

GST compliance refers to the adherence to the rules, obligations, and responsibilities outlined in the Goods and Services Tax Act. This involves a range of essential tasks, including proper invoicing, timely registration, accurate tax payment, and regular submission of returns. Ensuring compliance is crucial for maintaining smooth business operations and avoiding potential legal or financial penalties.

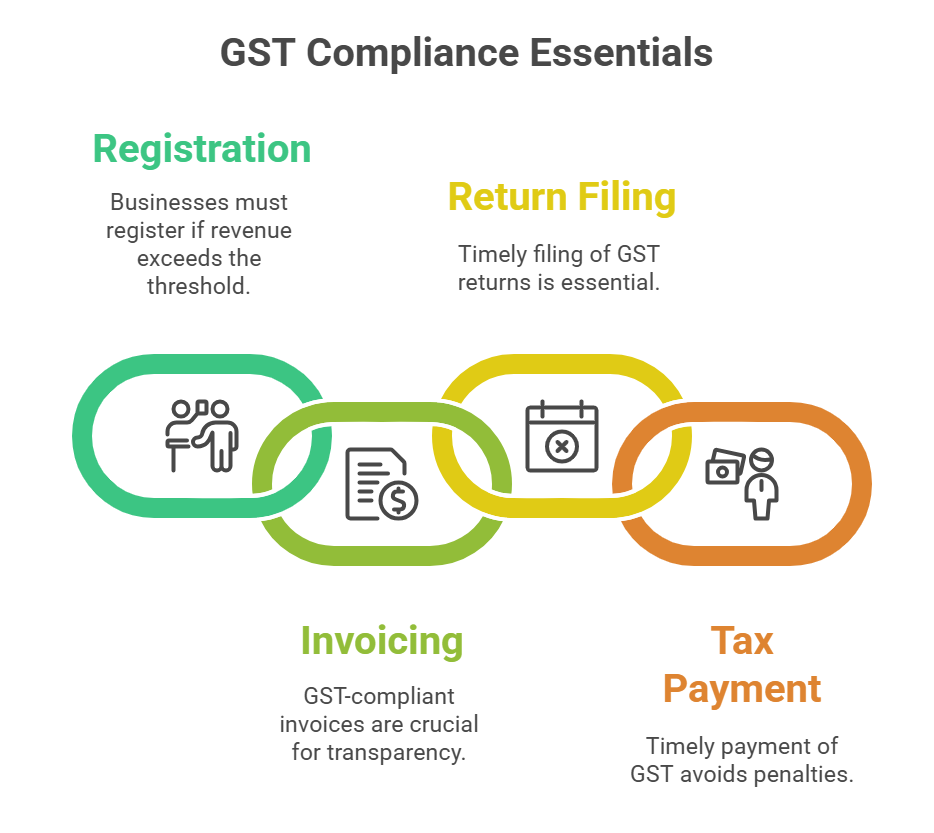

Significant Compliance Requirements in GST Summary

The following are essential requirements for GST compliance:

1. Registration: Businesses are required to register for GST if their revenue exceeds the designated level.

2. Invoicing: GST-compliant invoices are necessary for transparency and record-keeping.

3. Return Filing: GST returns must be filed on time in order to reflect sales, purchases, and tax liabilities.

4. Tax Payment: Businesses need to make sure that the GST owed is paid on time to avoid penalties.

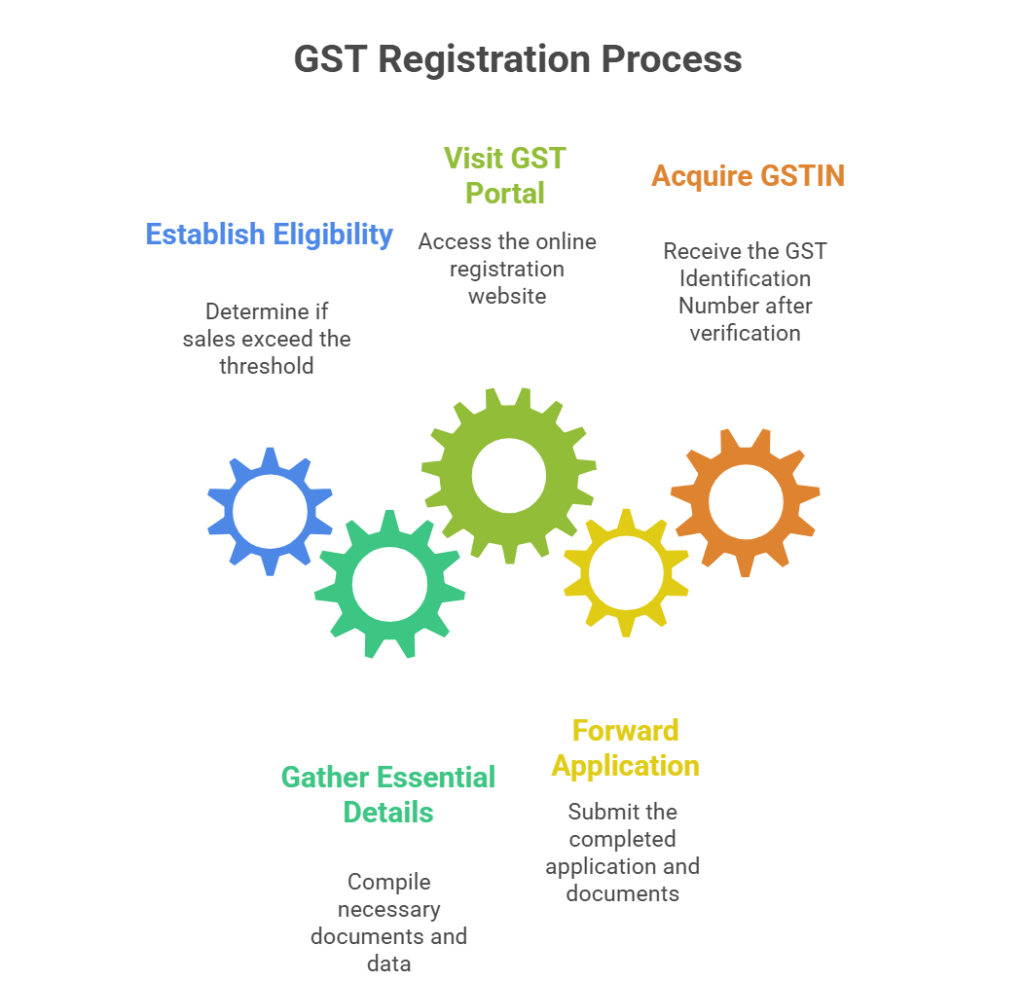

GST Registration Checklist

1. Establish Eligibility: Determine if your company’s sales exceed the GST registration threshold.

2. Gather the Essential details: Compile crucial data, like PAN, business address, bank account details, and identity documents.

3. Visit the GST Portal: Proceed to the GST online registration website and fill out the application, Form GST REG-01.

4. Forward the application: Once completed, submit the required documentation along with the application.

5. Acquire a GSTIN: After verification, you will receive a Goods and Services Tax Identification Number (GSTIN).

Requirements for GST Documentation Enrolling

The following documents are required:

- The applicant’s or the business’s PAN card.

- Certification of business registration, such as an incorporation certificate.

- Proof of the directors’ and promoters’ names and addresses; Consult any documentation

- Proving the company’s address, such as a rent agreement or electricity bill.

- A bank account statement that includes bank details.

Instructions for Creating GST-Compliant Bills

The following components of a GST-compliant invoice should be present:

- The word “Invoice” was prominently displayed.

- GST inside the supplier’s and recipient’s IN

- A description of the goods or services together with the date and invoice number

- HSN/SAC codes for the objects

- The total amount owed, including GST

- Date and invoice number

The Value of Keeping Correct Records for GST

Keeping correct records is essential for a number of reasons:

1. Facilitates Audits: Tax authorities find it simpler to do audits and inspections when accurate documentation is provided.

2. Input Tax Credit (ITC) redemption: Accurate paperwork ensures hassle-free ITC claim validity.

3. Openness: Precise records promote transparency and accountability in financial operations.

Making GST Returns

1. A Summary of the Different Types of GST Returns

Businesses must file several kinds of returns according to their operations and turnover. Among the significant returns are:

GSTR-1: Monthly or quarterly sales return.

GSTR-3B: When paying taxes, include a credit claim and a summary return.

GSTR-9: Annual Return for Regular Taxpayers.

2. Timetable and Deadlines for Submission of the Return

Knowing the filing dates is essential to avoid penalties:

GSTR-1: The deadline is the eleventh of the next month.

GSTR-3B: Needs to be filed by the twentieth of the following month.

GSTR-9: This has to be filed by the next fiscal year’s December 31st.

3. Typical Mistakes to Avoid When Submitting

- Incorrect PAN or GSTIN

- Mismatched invoice data

- Failure to disclose zero-rated or exempt suppliers

Commitment to the Input Tax Credit (ITC) regulations

1. Conditions for ITC Claims Eligibility

- Businesses that wish to submit an ITC claim must ensure that their products and services are used for commercial purposes.

- ITC is claimed for eligible purchases.

- The supplier has filed the required GST returns.

2. Documentation Needed to File an ITC Claim

- Purchase receipts with GST information

- Proof of payment for completed transactions and

- Acknowledgments for the provided services

3. Steps to Ensure Accurate Use of ITC

- Regularly review supplier invoices and ITC claims.

- To avoid ITC lapses, make sure your GST returns are filed on time.

- Regularly check for GST compliance to ensure correctness.

Making a GST payment

1. Understanding the Procedures for Paying GST

Online GST payments are available to users via the GST website. Businesses can choose from a range of payment options, including using applicable ITC, credit/debit cards, and net banking.

2. Significant Dates for GST Payment

The deadline for monthly GST payments is the twentieth of the following month. Pay on schedule to avoid penalties and interest.

3. Penalties for Late Payment

There are fines associated with non-compliance, and interest charges for late payments are applied at the yearly rate of 18%. It is important to adhere to the payment schedule in order to prevent unnecessary financial burden.

Respect for Audit Requirements

1. Overview of the Procedures for GST Audits

Tax authorities may also conduct internal audits related to GST. They assess the degree to which the GST regulations are being adhered to, verifying the correctness of the data maintained and the returns submitted.

2. Crucial Documents to Prepare for a GST Audit

- Invoices for purchases and sales

- Filed GST returns and documentation for ITC claims

- Financial statements and accounting records

3. The Importance of Internal Audits for Compliance

Regular internal audits help identify gaps in compliance and ensure that corrective action is taken quickly. They ensure that the GST regulations are followed and raise overall operational effectiveness.

Keeping Up with GST Amendments

1. The Importance of Understanding Modifications to the GST Laws

The laws that govern GST are always changing. Keeping up to date on information is essential to ensure consistent adherence and avoid penalties for non-compliance.

2. Monitoring Resources Updates on GST

The official website for GST regularly checks for changes and announcements. Trade publications: Subscribe to get newsletters from reputable sources.

3. Expert advice

Engage consultants or tax experts for information on current changes.

Conclusion

In the current tax system, businesses cannot operate legally or financially unless they comply with GST. By employing this checklist, businesses may handle the complexities of GST more simply. Regularly reviewing compliance processes can not only help the organization avoid penalties but also foster an honest and transparent culture. Implement these processes to ensure that your business complies with GST regulations.