Starting a new business venture in India is an exciting journey filled with potential, but it can also be a daunting task, especially when it comes to navigating the complexities of registration. In this comprehensive guide, we will walk you through the entire process of Indian startup registration, including Startup India, DPIIT recognition, and the startup registration process. By the end of this article, you’ll have a clear understanding of the steps involved and how to get your business registered seamlessly.

Understanding the Importance of Startup Registration

Before diving into the registration process, let’s explore why it is essential for startups to get themselves registered.

1. Legitimacy and Credibility

Registering your startup provides it with a legal identity, making it a legitimate entity in the eyes of the law. This not only enhances your business’s credibility but also builds trust among potential investors, partners, and customers.

2. Access to Government Schemes

Startups that are registered with the Indian government can avail themselves of numerous benefits and incentives provided under various government schemes. This includes financial support, tax exemptions, and more.

Initiating the Startup India Process

The Startup India initiative is a government-driven program aimed at fostering entrepreneurship and innovation in the country. Here’s how you can get started:

Eligibility Criteria

To be eligible for Startup India, your business must be:

- Less than 10 years old.

- Registered as a private limited company, partnership firm, or limited liability partnership.

- Your turnover should not exceed Rs. 100 crore in any of the previous financial years.

Online Registration

You can register your startup on the official Startup India website. Provide the necessary details and documents, including your business plan, and await approval.

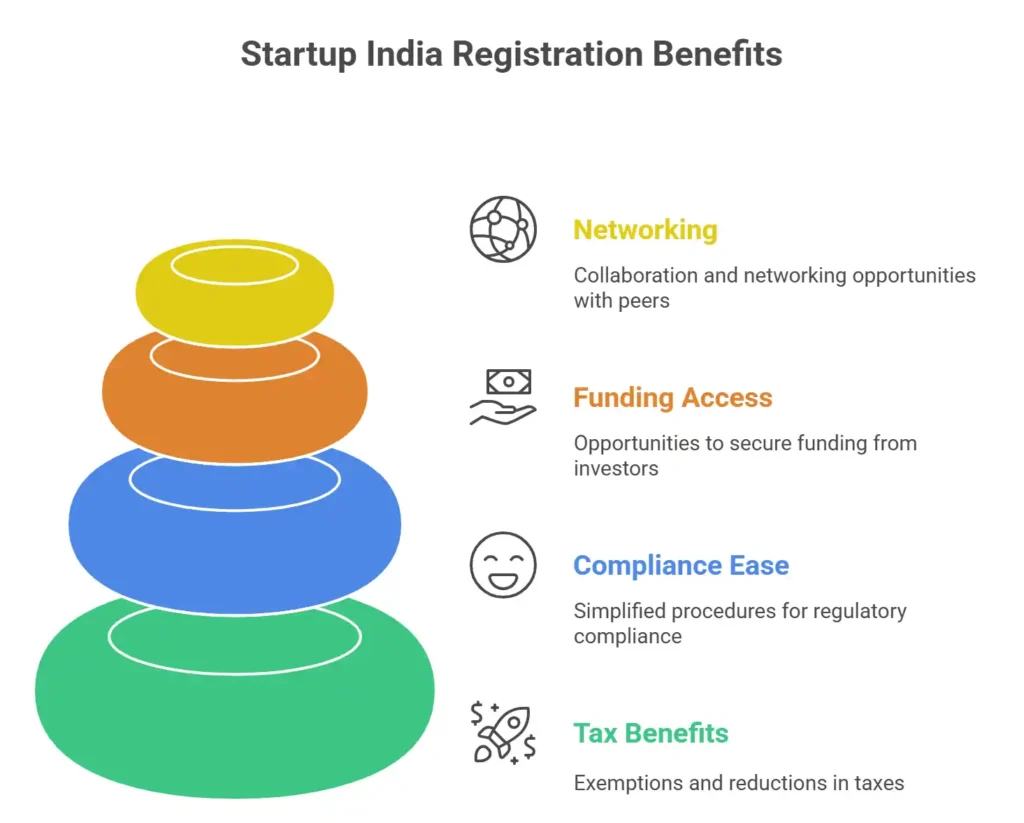

Benefits of Startup India Registration

Once approved, you gain access to various benefits such as:

- Tax benefits and exemptions.

- Simplified compliance procedures.

- Funding opportunities and access to investors.

- Networking and collaboration opportunities.

DPIIT Recognition for Your Startup

The Department for Promotion of Industry and Internal Trade (DPIIT) plays a crucial role in recognizing and promoting startups in India. Here’s how to secure DPIIT recognition:

1. Meeting the Criteria

To qualify for DPIIT recognition, your startup must meet certain criteria, including:

- Innovation and development of new products or services.

- Scalability and high potential for growth.

- A clear and detailed business plan.

2. Application Process

Submit your application for DPIIT recognition, providing all the necessary information and documents. Once approved, your startup gains official recognition and access to various benefits.

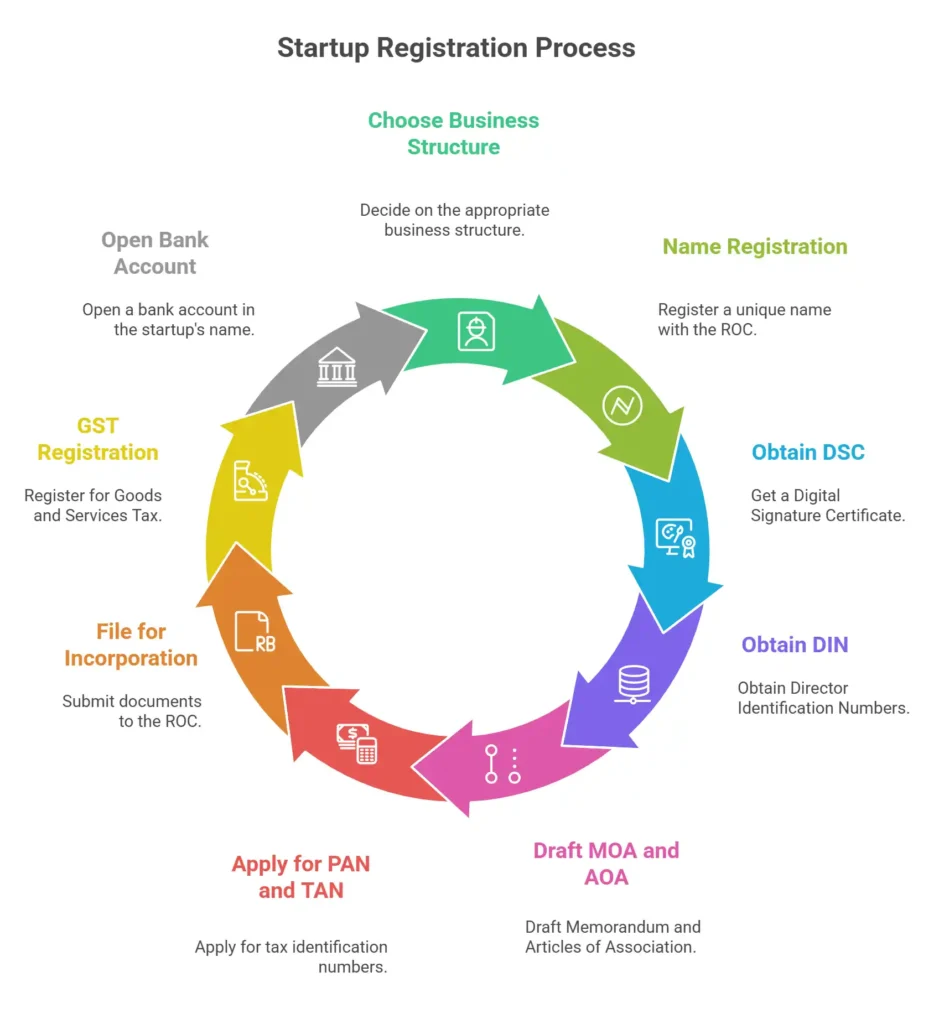

The Startup Registration Process

Now, let’s delve into the step-by-step process of registering your startup in India:

1. Choose a Business Structure

Decide on the appropriate business structure, whether it’s a sole proprietorship, partnership, LLP, or private limited company.

2. Name Registration

Choose a unique name for your startup and check its availability. Register it with the Registrar of Companies (ROC).

3. Obtain Digital Signature Certificate (DSC)

A DSC is essential for filing documents electronically with government authorities. Get your DSC from a certified agency.

4. Director Identification Number (DIN)

If you plan to have directors, obtain DIN for them. It is a special identifying number needed for company directors.

5. Memorandum and Articles of Association

Draft the Memorandum and Articles of Association (MOA and AOA) for your company. These documents outline your company’s objectives and rules.

6. Apply for PAN and TAN

Apply for a Permanent Account Number (PAN) and a Tax Deduction and Collection Account Number (TAN) for your startup.

7. File for Incorporation

Submit the necessary documents to the ROC for company incorporation. You’ll get a Certificate of Incorporation after it has been accepted.

8. GST Registration

If applicable, register for Goods and Services Tax (GST) to comply with tax regulations.

9. Bank Account

Open a bank account in your startup’s name and complete other post-incorporation formalities.

Conclusion

Getting your Indian startup registered is a significant milestone on your entrepreneurial journey. It provides legal recognition, access to government benefits, and credibility in the business world. By following the steps outlined in this article, you can navigate the process with ease and set your startup on the path to success.

Frequently Asked Questions (FAQs)

Q: Is Startup India registration mandatory for all startups?

A: No, it’s not mandatory, but it offers several advantages, so it’s recommended for eligible startups.

Q: How long does it take to get DPIIT recognition?

A: The processing time varies, but it typically takes a few weeks to a couple of months.

Q: Can foreign nationals register a startup in India?

A: Yes, foreign nationals can register a startup in India, subject to certain conditions.

Q: What are the tax benefits of startup registration?

A: Startups can avail themselves of tax exemptions and deductions under various government schemes.

Q: Are there any annual compliance requirements for registered startups?

A: Yes, registered startups must comply with annual filing and reporting requirements to maintain their status.

Don’t hesitate to reach out to us for further assistance on your startup registration journey.