Filing your Income Tax Return (ITR) is an essential task for all taxpayers. However, filing is just the first step. To complete the process, you must verify your ITR. Thankfully, the Income Tax Department provides multiple modes to e-verify your ITR conveniently. In this blog, we will discuss how to e-verify using different modes such as Aadhaar OTP, Net Banking, and more.

Why Is It Important to Verify Your ITR?

Verification of ITR ensures that the information provided in your tax return is accurate and that the Income Tax Department can process your return. If you fail to verify your ITR within the stipulated time (currently 30 days from filing), your return will be considered invalid.

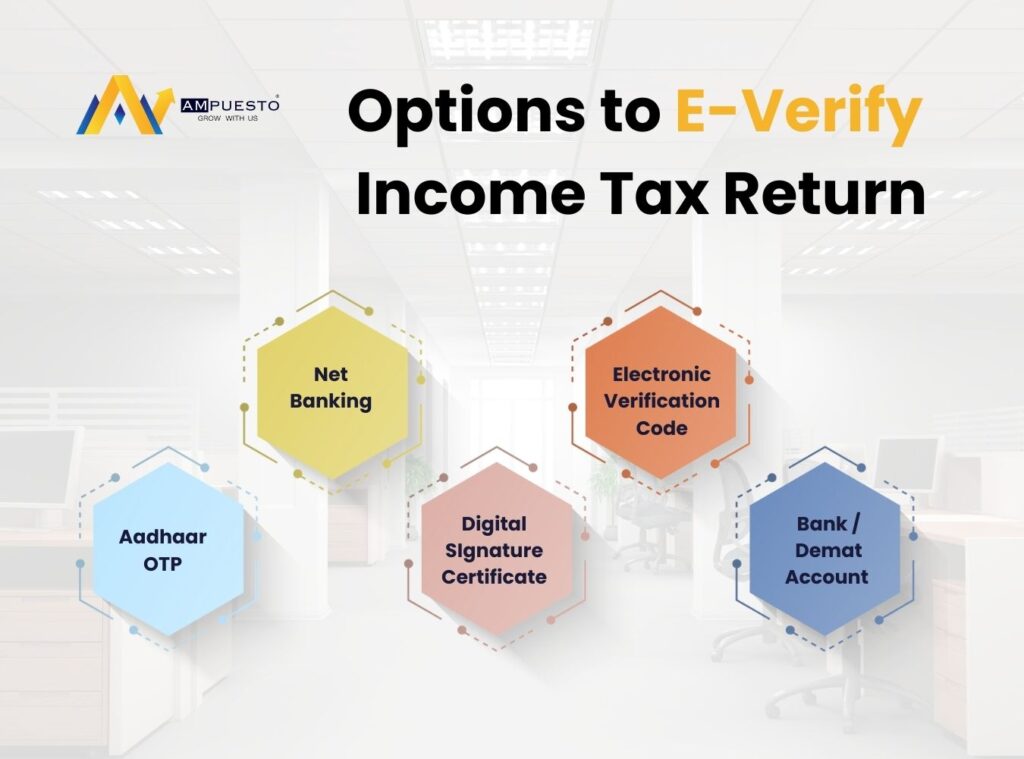

Modes to E-Verify Your ITR

The government offers several methods to e-verify your ITR, making the process seamless and user-friendly. Below, we will explore the most commonly used modes in detail.

1. E-Verify ITR Using Aadhaar OTP

Linking your Aadhaar to your PAN enables you to verify your ITR quickly through Aadhaar OTP.

Steps to Verify ITR Using Aadhaar OTP:

- Visit the official Income Tax e-filing portal and log in using your credentials.

- After logging in, navigate to the My Account section and select the e-Verify Return option.

- Choose the option to generate an Aadhaar OTP. Ensure that your Aadhaar is linked with your PAN and that your mobile number is updated.

- An OTP will be sent to your mobile number registered with Aadhaar.

- Enter the OTP in the specified field on the portal and click on the “Submit” button to complete the verification process.

Benefits:

- Simple and quick.

- No additional login credentials are required.

2. E-Verify ITR Using Net Banking

Net Banking is another secure mode to verify your ITR. It is ideal for those who frequently use online banking services.

Steps to Verify ITR Through Net Banking:

- Log in to your Net Banking account using your credentials. Ensure that the bank is authorized to provide e-verification services for ITR.

- Locate the “e-Filing” or “Income Tax” option in the menu. This feature is commonly found under the services or tax section.

- Select the e-filing option, which will redirect you to the Income Tax e-filing portal.

- Once redirected, log in to the Income Tax portal automatically via Net Banking.

- Go to the e-Verify Return section and confirm your details to complete the verification process.

Key Banks Offering Net Banking Verification:

- State Bank of India (SBI)

- HDFC Bank

- ICICI Bank

- Axis Bank

- Punjab National Bank

Benefits:

- Highly secure and efficient.

- No need to upload additional documents or rely on OTPs.

3. E-Verify ITR Using Digital Signature Certificate (DSC)

A Digital Signature Certificate (DSC) is another method for ITR verification, often used by professionals and companies.

Steps to Verify ITR Using DSC:

- Obtain a valid Digital Signature Certificate from an authorized service provider if you do not already have one.

- Install the DSC utility software on your computer to ensure compatibility with the Income Tax portal.

- Log in to the Income Tax e-filing portal using your credentials.

- Go to the e-Verify Return section and select the option to verify using DSC.

- Upload your DSC file when prompted and complete the verification process by following the on-screen instructions.

Benefits:

- Ideal for business and professional filings.

- Avoids dependency on OTPs or Net Banking access.

4. E-Verify ITR Using Electronic Verification Code (EVC)

Electronic Verification Code (EVC) is a unique 10-digit alphanumeric code that helps verify your ITR.

Steps to Verify ITR Using EVC:

1. Generate an EVC via one of the following methods:

- Using your pre-validated bank account.

- Generating it from your Demat account.

- Using a pre-validated ATM card linked to your PAN.

2. Once the EVC is generated, log in to the Income Tax e-filing portal and go to the e-Verify Return section.

3. Enter the EVC in the designated field and click on “Submit” to complete the verification process.

Benefits:

- Flexible as it offers multiple generation methods.

- Secure and widely accessible.

5. E-Verify ITR Through Bank Account or Demat Account

You can verify your ITR using a pre-validated bank or Demat account linked with your PAN.

Steps to E-Verify Using Bank/Demat Account:

- Log in to the Income Tax portal and pre-validate your bank or Demat account by providing the necessary details, including the account number and IFSC code.

- Once the account is validated, navigate to the e-Verify Return section.

- Select the option to verify using a bank or Demat account. An OTP will be sent to your registered mobile number.

- Enter the OTP received on your mobile number and submit the verification.

Benefits:

- Ensures accuracy by linking to trusted financial accounts.

- No additional device or software is needed.

Offline Mode: Send a Physical ITR-V to CPC Bengaluru

If you cannot e-verify through digital modes, you can send a signed physical copy of ITR-V to the Centralized Processing Centre (CPC) in Bengaluru.

Steps to Send ITR-V:

1. Download the ITR-V from the Income Tax portal after filing your return.

2. Print the ITR-V document and sign it using blue ink for clarity.

Post the signed document to the following address:

Centralized Processing Centre, Income Tax Department, Bengaluru – 560500.

3. Ensure that the ITR-V reaches the CPC within 30 days from the date of filing your return.

Comparison Table: Modes to E-Verify ITR

| Mode | Requires Internet? | OTP Needed? | Ideal For |

| Aadhaar OTP | Yes | Yes | Individual taxpayers |

| Net Banking | Yes | No | Bank account holders |

| DSC | Yes | No | Professionals/Businesses |

| EVC | Yes | Yes | All taxpayers |

| Physical ITR-V | No | No | Offline users |

Common FAQs on How to E-Verify ITR

1. Can I file an ITR without verifying it?

No, an unverified ITR is considered invalid by the Income Tax Department.

2. What is the deadline to verify an ITR?

You must verify your ITR within 30 days from the date of filing.

3. Can I change my verification method after filing?

Yes, you can choose any mode of verification available on the Income Tax portal.

Conclusion

E-verifying your Income Tax Return is a crucial step in the tax filing process. With multiple modes such as Aadhaar OTP, Net Banking, and DSC, you can choose the most convenient option. By understanding how to e-verify and utilizing the mode that best suits your needs, you can ensure that your ITR is processed without delays. Start the process today and make your tax filing experience hassle-free.