Choosing the right type of business structure for your business is an important decision that will have legal and financial impact on your business. The best business form for any individual or organization depends on various factors such as the nature of the business, the level of control and management desired, the number of owners, liability protection, tax implications, and financing needs.

If you are having confusion deciding which type of business form is best for you, this article will provide you with an analysis of the various types of business registration and the factors that influence your decision.

Here are some points that can help you understand the factors for different types of company registration suitable for your business:

1. Understand Different Types of Business Registrations

Before you choose a type of company registration, you need to understand the different types of company registrations that are available to you.

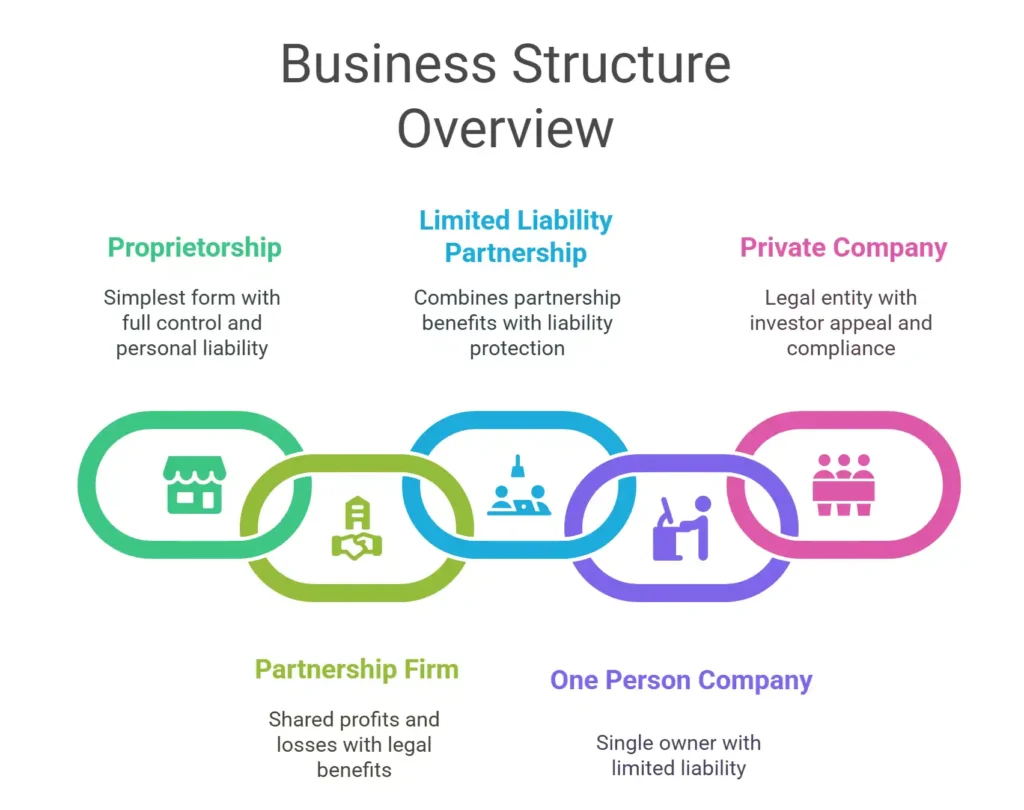

Some Common Business Structures are as Follows:

- Proprietorship

Proprietorship is a type of business ownership where the business is owned and operated by a single individual. The proprietor is responsible for all aspects of the business, including decision-making, management, and financing. Proprietorship is the simplest form of business organization and is often used by small businesses or sole traders who want to keep things simple and have full control over their businesses.

In a proprietorship, the owner is personally liable for all debts and obligations of the business. This means that if the business runs into financial trouble, the owner’s personal assets may be used to pay off the debts. However, the proprietorship structure has some advantages over corporate form of business, such as ease of formation, flexibility, low start-up costs, easy to windup, etc. Proprietorship is often used in businesses such as retail, service, and agriculture. The proprietorship model is common for small businesses, such as local shops, retailers, traders, etc.

- Partnership Firm

A partnership firm is a type of business where there is more than one individual and they share the profits and losses of the business in a predetermined ratio, as agreed upon in the partnership agreement. Partnership firms are governed by the Indian Partnership Act of 1932, which defines a partnership as “the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.”

In India, partnership firms can be registered or unregistered. However, it is recommended to register a partnership firm with the Registrar of Firms in order to enjoy certain legal benefits, such as the ability to sue third parties or other partners and to enjoy a separate legal status. Ultimately, the partnership registration for your business will depend on your specific needs and circumstances. By considering the factors mentioned above and consulting with experts, you can make an informed decision and choose for partnership registration of your business.

- Limited Liability Partnership (LLP)

This is the extended version of Partnership. A limited liability partnership (LLP) is a type of business entity that combines the benefits of a partnership with limited liability protection along with status as a company. In LLP, each partner is only responsible for their own actions and debts, and they are not liable for the actions or debts of other partners in the partnership.

LLPs are commonly used by professionals such as lawyers, accountants, architects, doctors and professionals as well as businesses in the consultancy and real estate sectors. They offer flexibility in terms of management and ownership structure, allowing partners to have different levels of involvement and financial contributions.

To form an LLP, partners must register with the Registrar of Companies and file a partnership agreement outlining the roles and responsibilities of each partner. LLPs are subject to income tax at the rate of flat 30% on their profits and also have annual compliance requirements, and they must follow specific rules regarding financial accounting and management. Overall, LLP is a good choice for businesses that want the benefits of a partnership while limiting their liability and protecting their personal assets.

- One Person Company (OPC)

This is not such a popular type of Business Form as it is a combination of Private Ltd Company and Proprietorship. A single owner/Proprietor makes OPC by registering in MCA as a Pvt Ltd Company. As far as compliances are concerned, One Person Company is governed by Companies Act and all the compliances mentioned in Companies Act will have to be met by OPC including Compulsory annual Audit by a Chartered Accountant.

OPC also shares most of the similarities like private companies as OPC provides limited liability protection to its member, which means that the member’s personal assets are protected in case of any business losses or liabilities. It is ideal for entrepreneurs who want to start a business with limited liability protection, but do not have the resources to set up a private limited company

- Private Limited Company

This is the most popular or recognized form of Business Registration amongst Banks, Investors, and Entrepreneurs. A company is a legal entity that is separated from its owners, with the purpose of conducting business activities. The process involves registering the company with the relevant government authority and obtaining legal recognition as a separate entity. This is the most preferred business form in the context of startups seeking funding from Investors.

It is governed by Companies act like OPC and all the compliances including Annual Audit will have to be met by the Company. In terms of Compliances, this is the most difficult form of Business in which every event or task is performed by filling form to MCA but considering a long-term view for the Business, tax benefit is allowed to them in comparison to other forms of registration which makes it more beneficial for the entrepreneur.

2. Determine the Nature of Your Business

The nature of your business will also play a role in the type of company registration you choose. For example, if you have a small business with little funding or capital for investment, a sole proprietorship or partnership firm may be the best option. On the other hand, if you have a larger business with significant assets, liabilities and capital, an LLP or Company incorporation may be more appropriate.

3. Tax Implications

Different types of company registrations have different tax implications. For example, a sole proprietorship business is taxed as slab rate basis, while an LLP, Partnership firm, and Company are taxed at a flat rate. However businessman must also consult with a professional to determine the tax implications of each type of company registration before registering it.

4. Registration and Compliance Charges

The registration cost in most cases is very similar. However, Proprietorship businesses are easy and inexpensive to form. As registration is a one-time cost, you should focus on maintenance and compliance costs. It mainly includes the cost of compliance. The compliance level in a company is the highest, followed by an LLP. Continuous and event-based compliance are also required to be considered, especially in the case of company and LLP.

5. Consider the Legal Liability

The level of legal liability you are willing to assume is another important factor in choosing the right type of company registration. For example, a sole proprietorship and partnership firm offers no protection from personal liability, while an LLP or company provides limited liability protection.

6. Evaluate Your Financial Situation

Consider how much capital you have available to start your business and how much you need to sustain it. Determine your budget and financial projections.

7. Seek Professional Advice

Consult with professionals, such as lawyers, accountants, and business advisors, to help you choose the right business structure and navigate legal and financial requirements. They will assist you in determining the best type of business registration to begin based on your financial situation.