Selling a property in India often leads to a capital gain, which can attract tax implications. When you sell a property, the profit you earn is subject to tax. Depending on how long you’ve owned the property, you’ll either pay short term capital gain tax or long term capital gain tax. Understanding the difference between the two, their rates, and the exemptions available is key to smart tax planning.

In this blog, we’ll cover all key aspects of capital gains on property transactions, including exemptions under the Income Tax Act and changes introduced in the latest budget.

What is Capital Gain?

Capital Gain refers to the profit earned from the sale of a capital asset like land, building, or house property. These gains are subject to taxation under the Income Tax Act’s “Capital Gains” heading.

There are two types:

1. Short Term Capital Gain (STCG): When the property is held for less than 24 months before sale.

2. Long Term Capital Gain (LTCG): When the property is held for 24 months or more.

Tax Rates Applicable

- STCG(Short Term Capital Gain): Taxed according to the seller’s applicable income tax slab.

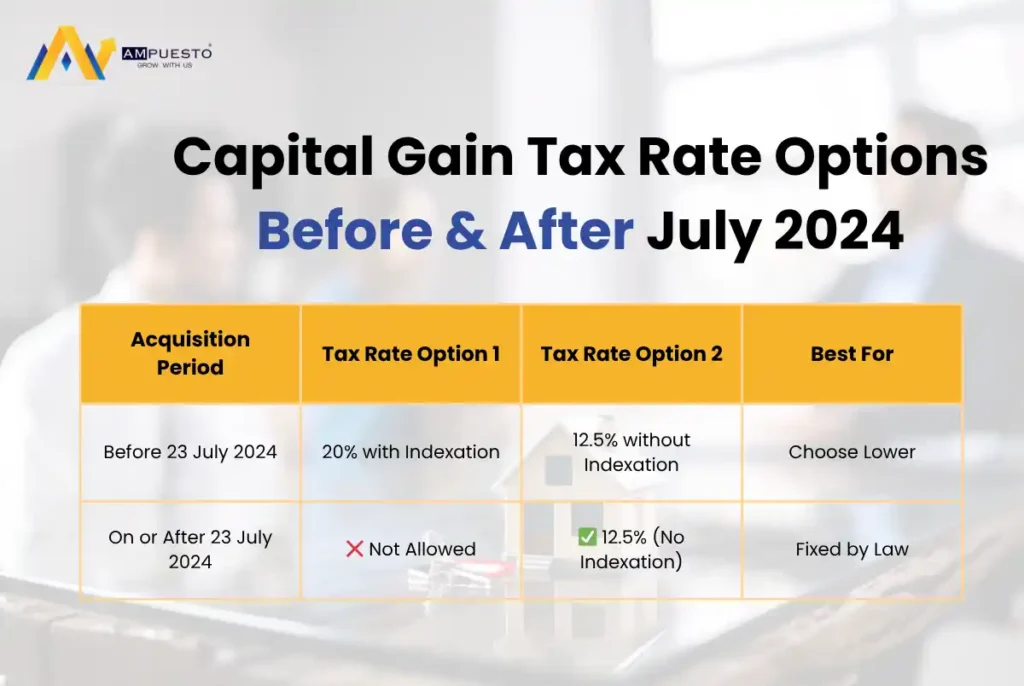

- LTCG (Before 23 July 2024): Taxed at 20% with indexation benefit.

- LTCG (From 23 July 2024):

- If property acquired before 23 July 2024, the taxpayer has an option to choose between 20% with indexation and 12.5% without indexation.

- If property acquired on or after 23 July 2024, only 12.5% tax without indexation is applicable.

Note: This option is available only to Resident Individuals and HUFs.

Important Note on Reporting in ITR:

While taxpayers may choose between the two tax rates for the purpose of computing their tax liability, the capital gain must still be reported without indexation in the income tax return (ITR). The computation with indexation is used only to determine which option results in lower tax payable. Hence:

- Declare the full gain without indexation in the return.

- Apply indexation only in tax calculation, not in the reported income.

This distinction is critical for proper compliance and accurate filing.

Exemptions Available Under the Income Tax Act

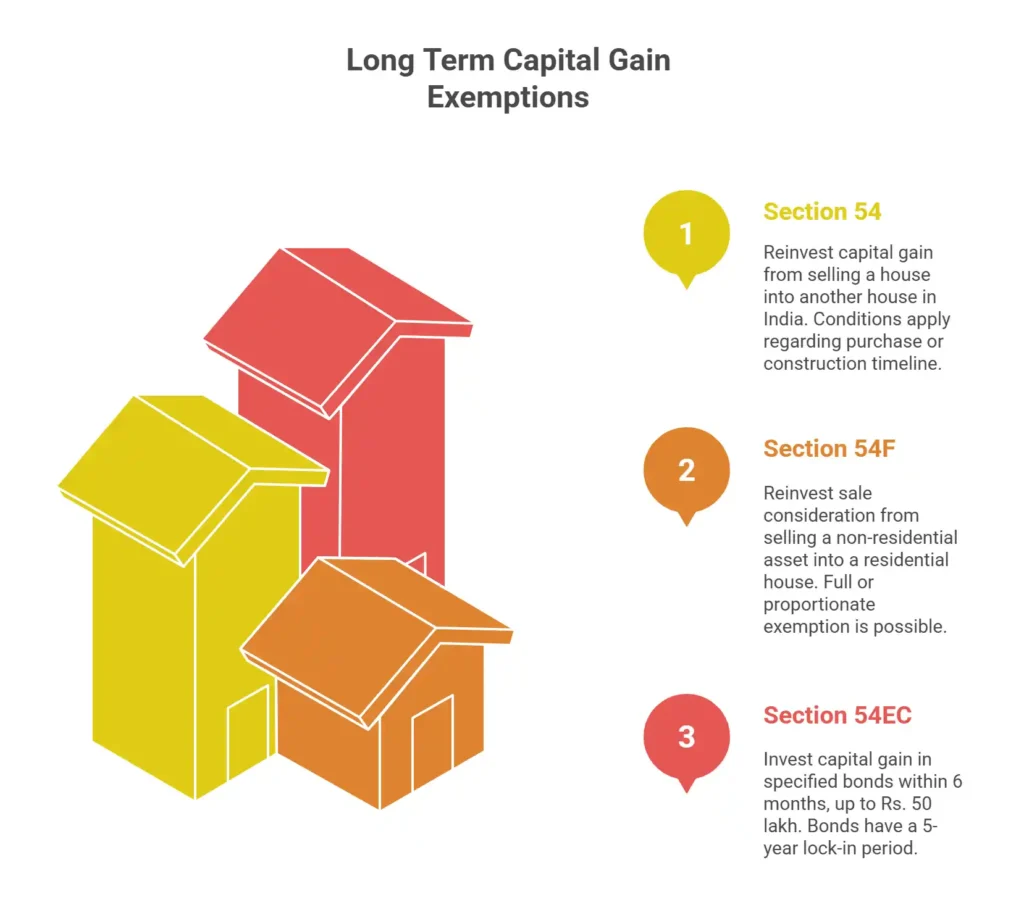

To reduce the tax burden on LTCG(Long Term Capital Gain), the Income Tax Act provides several exemptions:

1. Section 54

- Applicable when the capital gain arises from the sale of a residential house.

- Exemption allowed if the gain is reinvested in another residential house property in India.

- Conditions:

- The new property must be purchased within 1 year before or 2 years after the transfer, or constructed within 3 years.

- If LTCG exceeds Rs. 10 crore, exemption is limited to Rs. 10 crore (as per recent amendment).

2. Section 54F

- Applicable when the asset sold is not a residential house (e.g., land or commercial property).

- Full sale consideration must be reinvested in a residential house to get full exemption.

- Proportionate exemption if a partial amount is invested.

- Conditions similar to Section 54.

3. Section 54EC

- Capital gain invested in specified bonds (NHAI, REC, etc.) within 6 months.

- Maximum investment allowed: Rs. 50 lakh.

- Bonds have a lock-in period of 5 years.

Recent Amendments (Applicable from AY 2024-25)

a. Cap on Exemption Amount under Sections 54 and 54F

A maximum cap of Rs. 10 crore has been introduced on the amount of capital gain eligible for exemption under both sections.

b. Capital Gains Account Scheme (CGAS)

If the amount is not immediately invested, it must be deposited in CGAS before the due date of filing ITR.

c. New Definition of Cost of Acquisition (inherited/gifted properties)

The cost of acquisition for properties received through gift/will/inheritance will include the cost incurred by the previous owner.

d. New Tax Rate Option from 23 July 2024

Option to choose between 20% with indexation and 12.5% without indexation for LTCG arising on sale of property acquired before 23 July 2024.

For properties acquired on or after this date, LTCG(Long Term Capital Gain) will be taxed at 12.5% without indexation only.

Planning Tips

- Always consider the holding period before selling to enjoy LTCG benefits.

- Evaluate both tax options (with and without indexation) to choose the lower one.

- Remember to report capital gains without indexation in ITR, even if you choose indexation for tax calculation.

- Plan reinvestment carefully and maintain proper documentation.

- Invest through CGAS if unsure about immediate reinvestment.

- Reach out to AMpuesto for proper reporting, capital gain computation, and complete tax compliance support.

Example Calculation: Indexation vs. Non-Indexation

Let’s consider the following property transaction:

- Sale Price: ₹1,60,00,000 (Date of Sale: 25/02/2025)

- Purchase Price: ₹23,03,535 (Date of Purchase: 01/04/2003)

Capital Gain Calculation:

- Indexed Cost of Acquisition = ₹76,71,406

- LTCG (With Indexation) = ₹83,28,594

- LTCG (Without Indexation) = ₹1,36,96,465

- Tax @ 20% (With Indexation) = ₹16,65,719

- Tax @ 12.5% (Without Indexation) = ₹17,12,058

👉 Conclusion: In this case, opting for indexation results in lower tax liability, so the 20% rate with indexation is preferable.

Conclusion

With changing regulations and a more transparent tax regime, it’s essential to stay updated on how capital gains from property are taxed. The recent amendments, especially the choice between indexed and non-indexed taxation, aim to offer flexibility while also limiting high-value exemptions. Proper tax planning and timely investment can help you make the most of the available exemptions while staying compliant.

Stay informed. Stay compliant. And for any assistance with tax planning, capital gains calculation, or filing your ITR, reach out to the experts at AMpuesto – your trusted partner for tax and financial compliance.

Explore More with AMpuesto

At AMpuesto, we specialize in capital gains tax planning, property sale taxation, and ITR filing services. Whether you are selling residential or commercial property, our team ensures you maximize exemptions and stay compliant with the latest tax laws.

Talk to our experts today or visit AMpuesto to explore our services like Virtual CFO, GST return filing, income tax compliance, and investment advisory.