Introduction

Input Tax Credit (ITC) is one of the most significant advantages of the Goods and Services Tax (GST) regime in India. It allows businesses to offset the GST paid on purchases (inputs) against the GST payable on sales (output). However, claiming ITC is subject to various conditions, eligibility criteria, and legal provisions under the GST Act.

This blog provides a detailed understanding of ITC provisions, including GST input tax credit eligibility, the step-by-step ITC claim process, ineligible ITC, time limits for claiming ITC, and refund-related rules.

Understanding Input Tax Credit (ITC)

Input Tax Credit (ITC) refers to the mechanism under GST that allows businesses to reduce their tax liability by claiming a credit for the tax paid on purchases of goods or services used for business purposes. It ensures that tax is only levied on the value addition at each stage of the supply chain and prevents cascading taxation.

For instance, if a manufacturer buys raw materials worth ₹1,00,000 and pays GST of ₹18,000, and later sells the final product for ₹2,00,000 with GST of ₹36,000, the ITC mechanism allows them to deduct the ₹18,000 already paid from the final GST liability. Thus, they will only need to pay ₹18,000 as the net GST amount.

The primary objective of ITC under GST is to ensure tax neutrality and provide businesses with a seamless credit mechanism, preventing unnecessary tax burdens. By utilizing ITC efficiently, businesses can reduce their tax outgo and enhance profitability.

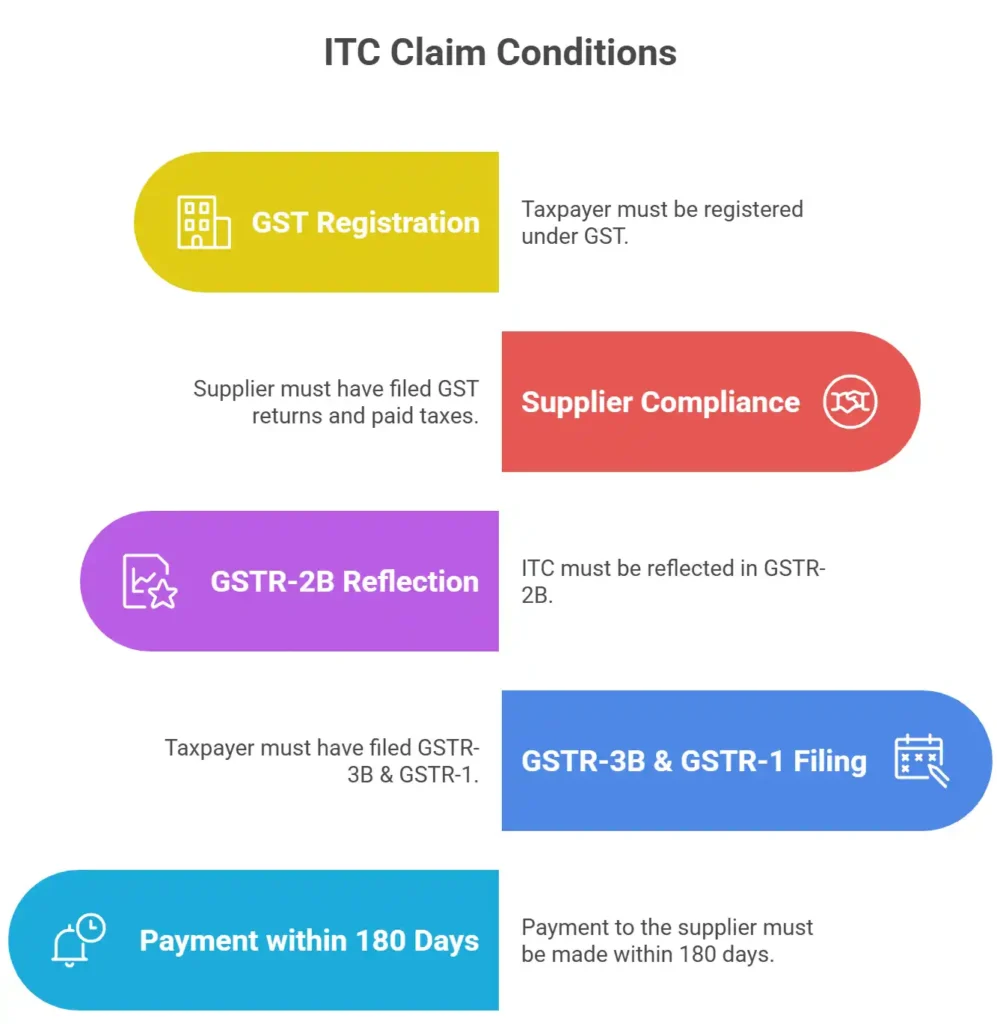

Conditions for Claiming ITC (Section 16 of GST Act)

To claim Input Tax Credit under GST, certain conditions must be met as per Section 16 of the GST Act:

A taxpayer must be registered under GST and must have received goods or services intended for business use. The ITC claim is valid only if the supplier has filed GST returns and paid the tax collected to the government. A valid tax invoice or debit note should be available as proof of transaction. Additionally, the ITC must be reflected in GSTR-2B, an auto-generated statement that ensures the legitimacy of the claim.

Moreover, the taxpayer must have filed GSTR-3B & GSTR-1. If the payment to the supplier is not made within 180 days, the ITC claimed needs to be reversed until the payment is completed. Failure to meet any of these conditions can lead to denial of ITC claims, which can impact the financial planning of a business.

ITC on Different Types of Supplies (Section 17(1) to 17(4))

Under Section 17 of the GST Act, ITC eligibility depends on the nature of the supply. ITC is generally allowed on taxable supplies, which means any purchases made for business purposes that contribute to taxable sales can avail ITC. Additionally, zero-rated supplies, such as exports and Special Economic Zone (SEZ) supplies, are also eligible for ITC, and businesses can claim a refund on such credit.

However, ITC is not allowed on exempt supplies, meaning if a business deals in goods or services that are exempt from GST, they cannot claim ITC on inputs related to such exempt sales. ITC is also not permitted for goods or services used for personal consumption or non-business activities. Businesses need to carefully segregate their purchases to ensure ITC is claimed correctly.

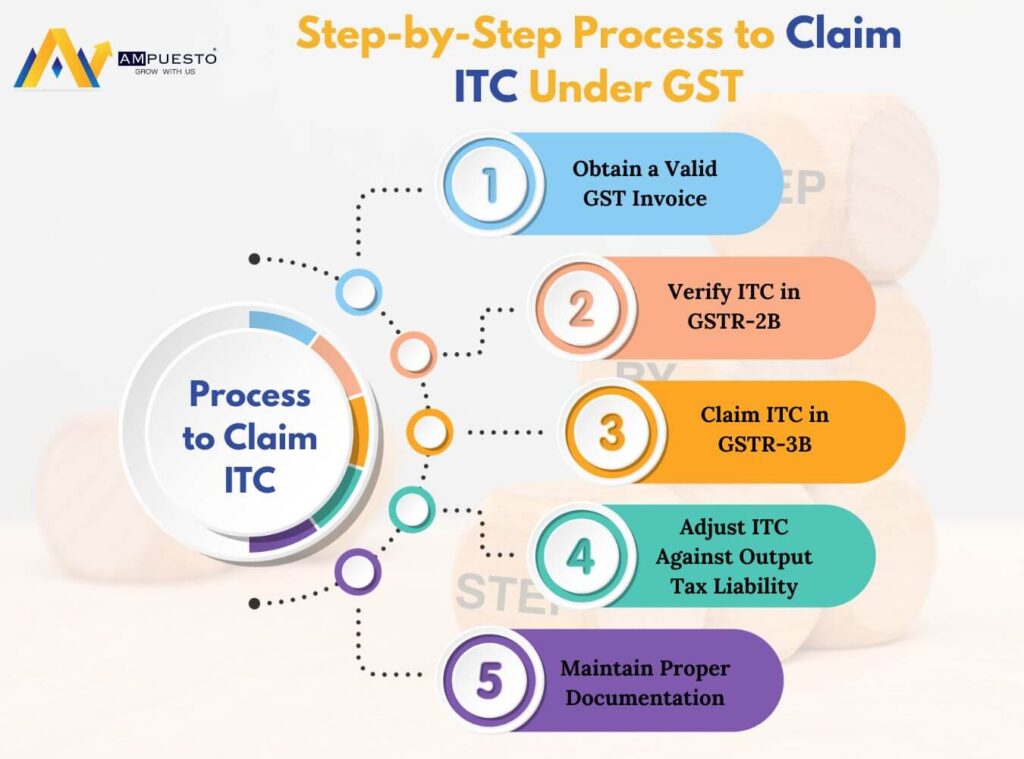

Step-by-Step ITC Claim Process

Claiming Input Tax Credit (ITC) under GST is a structured process that requires businesses to follow specific steps to ensure compliance and accuracy. Below are the steps businesses must take to claim ITC correctly:

1. Obtain a Valid GST Invoice

Ensure that every purchase made for business purposes is backed by a valid tax invoice, debit note, or bill of entry. These documents act as proof that GST has been paid to the supplier and are essential for claiming ITC. Without a proper invoice, ITC cannot be claimed.

2. Verify ITC in GSTR-2B

ITC details must be cross-checked in GSTR-2B, which is an auto-generated statement reflecting the ITC available based on suppliers’ GSTR-1 filings. If any mismatch occurs, businesses should reconcile discrepancies before proceeding with the claim.

3. Claim ITC in GSTR-3B

After verification, businesses must report the eligible ITC while filing GSTR-3B, which is the monthly GST return. Only the ITC reflected in GSTR-2B should be claimed to avoid errors and future notices from tax authorities.

4. Adjust ITC Against Output Tax Liability

Once ITC is claimed, it is used to offset the GST payable on outward sales. This reduces the tax burden, ensuring that businesses only pay the net GST amount after adjusting the available ITC.

5. Maintain Proper Documentation

Businesses should keep a well-maintained record of invoices, payments, and reconciliations to support their ITC claims during audits. Regular reconciliations help in identifying any discrepancies early and avoiding unnecessary ITC reversals or penalties.

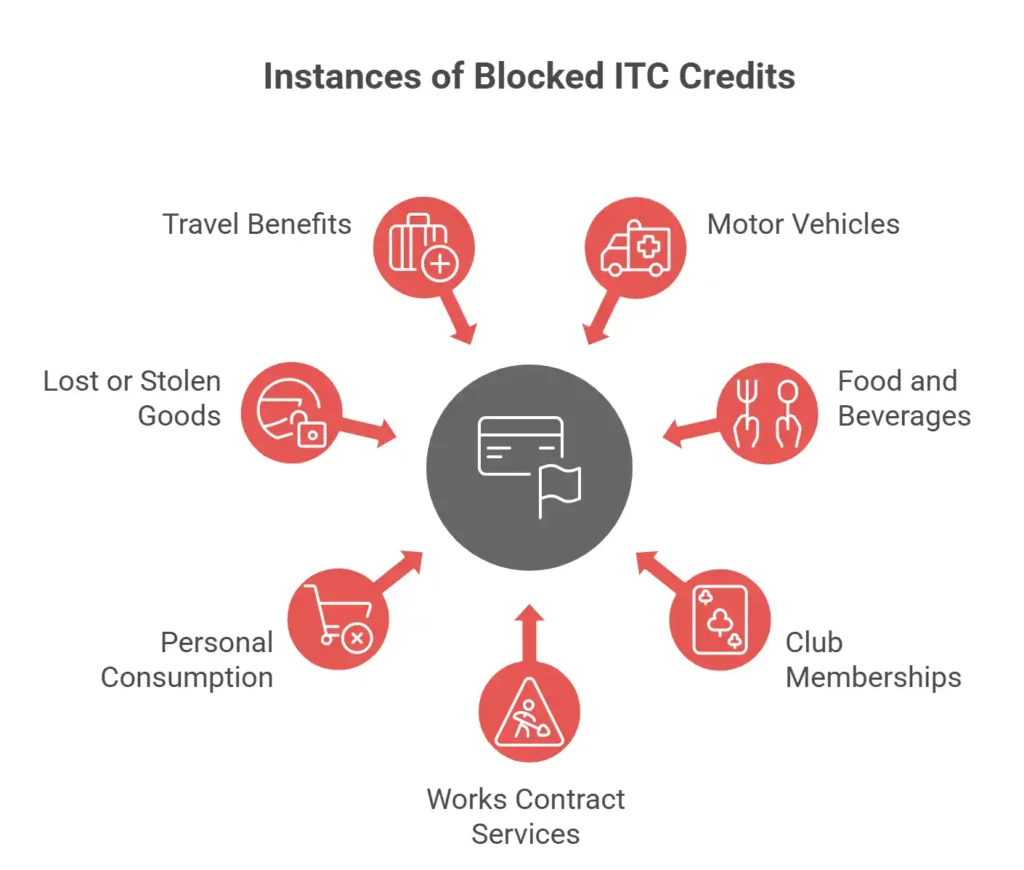

ITC Not Allowed (Blocked Credits) – Section 17(5)

Instances of Blocked Credits:

- Motor Vehicles and Conveyances – ITC is restricted unless used for specific activities like transport of goods or training services.

- Food, Beverages, and Catering Services – ITC is blocked unless the taxpayer is engaged in supplying the same.

- Club Memberships, Health, and Fitness Center Subscriptions – ITC is restricted for personal wellness services.

- Works Contract Services and Construction of Immovable Property – ITC is blocked unless used for further supply.

- Personal Consumption and Employee Benefits – ITC is not allowed for goods used personally.

- Goods Lost, Stolen, Destroyed, or Given as Free Samples – ITC is blocked in such cases.

- ITC on Travel Benefits – Expenses related to employee travel benefits are ineligible unless required by law.

ITC Treatment If Payment to Supplier Is Delayed

Under GST law, a business can claim Input Tax Credit (ITC) only if the payment to the supplier is made within 180 days from the date of the invoice. If the payment is delayed beyond 180 days, the ITC previously claimed must be reversed and added to the tax liability in the next return. Additionally, interest may also be applicable on the reversed ITC.

However, this reversal is not permanent. Once the pending payment is made to the supplier, the business can reclaim the ITC in a future GST return. This rule ensures that businesses do not misuse ITC benefits by claiming credit without actually paying their suppliers.

To avoid such reversals and extra interest costs, businesses should keep track of invoice due dates and reconcile their payments regularly. Using accounting software or automated GST reconciliation tools can help businesses ensure that supplier payments are made on time, allowing them to retain their ITC without any hassle.

Maximum Time Limit for Claiming ITC

The Goods and Services Tax (GST) Act specifies a clear deadline for claiming Input Tax Credit (ITC). A registered taxpayer must claim ITC within the earlier of the following dates:

- 30th November of the next financial year to which the invoice pertains.

- The due date of filing the annual return (GSTR-9) for that financial year.

For example, if an invoice is dated April 10, 2023, ITC on this invoice can be claimed only until November 30, 2024, or before filing GSTR-9 for FY 2023-24, whichever is earlier.

If ITC is not claimed within this period, it lapses permanently and cannot be used in future tax periods. Therefore, businesses should regularly reconcile their ITC with GSTR-2B and ensure timely claims to avoid financial loss.

Can ITC Be Claimed as a Refund?

Businesses can claim Input Tax Credit (ITC) as a refund in certain cases where excess credit remains unutilized. This usually happens in two main situations:

- Zero-Rated Supplies (Exports & SEZ Supplies)- When a business makes exports or supplies to a Special Economic Zone (SEZ) without paying GST, they accumulate ITC because no tax is collected on sales. In such cases, the business can apply for a refund of unutilized ITC.

- Inverted Duty Structure– This occurs when the GST rate on purchased inputs (raw materials) is higher than the GST rate on the final product being sold. Due to this mismatch, businesses may have excess ITC that cannot be used for tax payments. Such businesses can apply for a refund of the excess ITC.

To claim the refund, businesses must file Form GST RFD-01 on the GST portal and submit supporting documents, such as invoices and tax payment details, for verification.

Which Liabilities Cannot Be Adjusted Through ITC?

ITC cannot be used for adjusting certain GST liabilities. The following must be paid in cash via the electronic cash ledger:

- Late fees & interest on delayed payments.

- Penalties for GST non-compliance or violations.

- Reverse Charge Mechanism (RCM) tax payable, which can be claimed as ITC only after payment.

Conclusion

Understanding ITC provisions, claim processes, and restrictions is crucial for businesses to maximize tax savings and remain GST compliant. Proper ITC management not only reduces tax liability but also ensures better cash flow and efficient financial planning.

Additionally, businesses must be proactive in maintaining accurate records, ensuring supplier compliance, and timely claiming ITC to avoid unnecessary tax burdens.

For expert assistance on GST compliance and ITC claims, contact AMpuesto – Your Trusted Tax Partner.