Introduction

Understanding the Annual Information Statement (AIS) and Taxpayer Information Summary (TIS) is crucial for seamless tax compliance. Both play distinct yet complementary roles in simplifying the Income Tax Return (ITR) process. This blog explains the key differences, components, and benefits of AIS and TIS, guiding you on how to use them effectively for accurate and hassle-free tax filing.

AIS Meaning

The Annual Information Statement (AIS) is a document that provides a detailed account of a taxpayer’s financial transactions for a specific financial year. Introduced by the Income Tax Department of India, AIS serves as a transparent tool for taxpayers to view their income, taxes paid, and other financial activities. It acts as a single report for all reported financial data, offering taxpayers a clear perspective on their fiscal activities.

TIS Meaning

The Taxpayer Information Summary (TIS) is a short version of the AIS. It provides a summarized view of key financial information that is categorized and structured for easier understanding. TIS is especially designed to simplify tax filing by offering concise data relevant to taxable income, deductions, and taxes paid. While AIS offers exhaustive details, TIS focuses on presenting actionable insights for taxpayers.

Difference Between AIS and TIS

| Parameter | AIS | TIS |

|---|---|---|

| Purpose | Given at the item level in AIS | Clean, category-wise summary after de-duplication |

| Granularity | Entry-level details with source & dates | Totals by category with Processed & Accepted values |

| Source | Banks, brokers, registrars, employers, SFT filers | Derived from AIS after rules + your feedback |

| Prefill impact | Indirect | Direct (used for ITR prefill when available) |

| Feedback | Where in the portal | Reflects accepted AIS feedback automatically |

| Formats | PDF, JSON, CSV | PDF, JSON, CSV |

| Salaried with a simple income | Login → Services → AIS → AIS tab | Login → Services → AIS → TIS tab |

| Best for | Deep checks, tracing mismatches | Quick filing snapshot |

| Typical errors seen | Duplicates, wrong PAN/FY, zero cost for legacy shares, missing TDS | Mis-categorized totals, not reflecting feedback yet |

| Who should rely on it | Traders, business/profession, property/NRI cases | Salaried with simple income |

For instance, if AIS records 10 separate mutual fund transactions, TIS will group them into a net gain/loss summary. This distinction makes TIS especially helpful for individuals who want to focus on the bottom line without delving into detailed transaction data.

Role of AIS and TIS in ITR

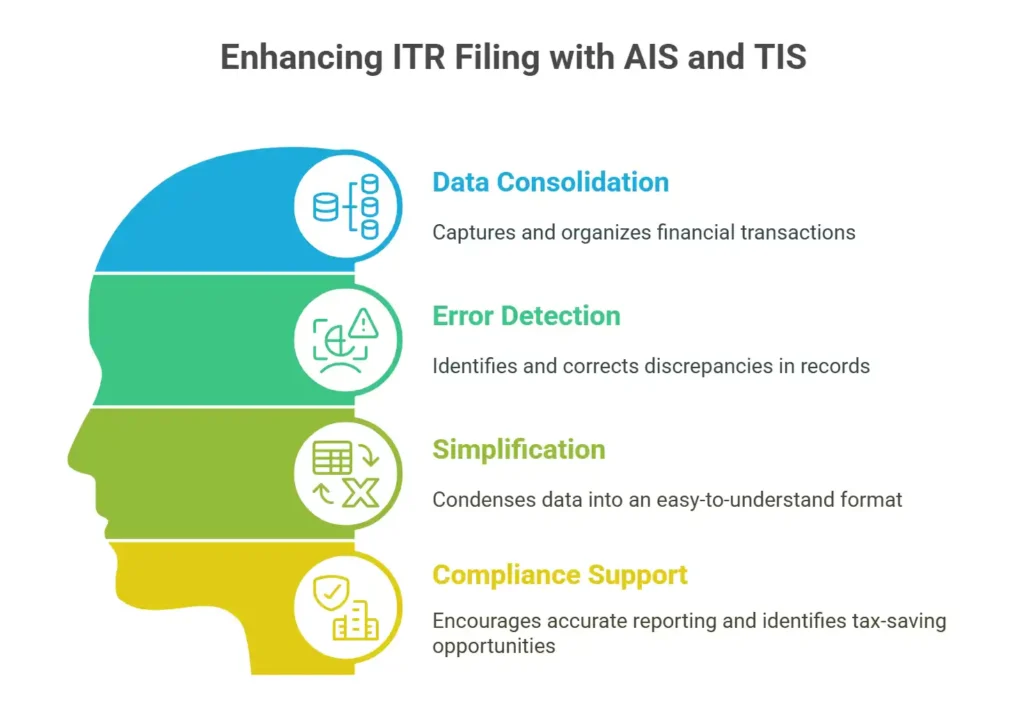

AIS and TIS have a very important role in streamlining the ITR filing process. Here’s how they contribute:

- Data Consolidation: AIS captures all financial transactions like income, investments, and taxes, making it easier for taxpayers to reconcile records. This comprehensive view ensures nothing is overlooked while preparing tax returns.

- Error Detection: By reviewing AIS and TIS, discrepancies can be identified and rectified, ensuring accurate returns. For instance, if a transaction is recorded incorrectly, you can highlight the discrepancy and have it corrected.

- Simplification: TIS condenses detailed AIS data into an easy-to-understand format, helping taxpayers focus on key figures for tax filing. This is particularly useful for individuals who may not have expertise in interpreting detailed financial data.

- Compliance Support: These tools encourage accurate reporting, reducing the risk of penalties. They also help in identifying tax-saving opportunities by presenting all income and deductions clearly.

Components of AIS and TIS

AIS includes a wide range of financial information, providing a detailed picture of a taxpayer’s fiscal activities:

- Income Details: Includes salary, interest income, rental income, and any other income sources.

- Investment Transactions: Records of dividends, mutual fund purchases or sales, and capital gains.

- Property Transactions: Details of property purchases, sales, and rental income.

- Tax Paid: Information about TDS (Tax Deducted at Source), TCS (Tax Collected at Source), and advance tax payments.

- GST Data: Contains GST-related transactions for businesses.

- Foreign Remittances: Tracks international transactions and foreign income.

AIS serves as a detailed ledger for all these categories, helping taxpayers verify the accuracy of their financial data.

TIS, as a summarized version of AIS, organizes financial data into key categories for simplified interpretation:

- Categorized Income Summary: Provides a summarized view of income sources like salary, business income, and other income.

- Investment Overview: Condenses information on dividends, capital gains, and mutual fund transactions.

- Tax Paid Summary: Highlights total taxes paid, including TDS and advance tax.

- Transaction Trends: Compares financial trends over previous years for a better understanding.

TIS focuses on key takeaways from AIS, making it ideal for taxpayers who want a quick and clear understanding of their financial data.

How to Check Both: AIS and TIS

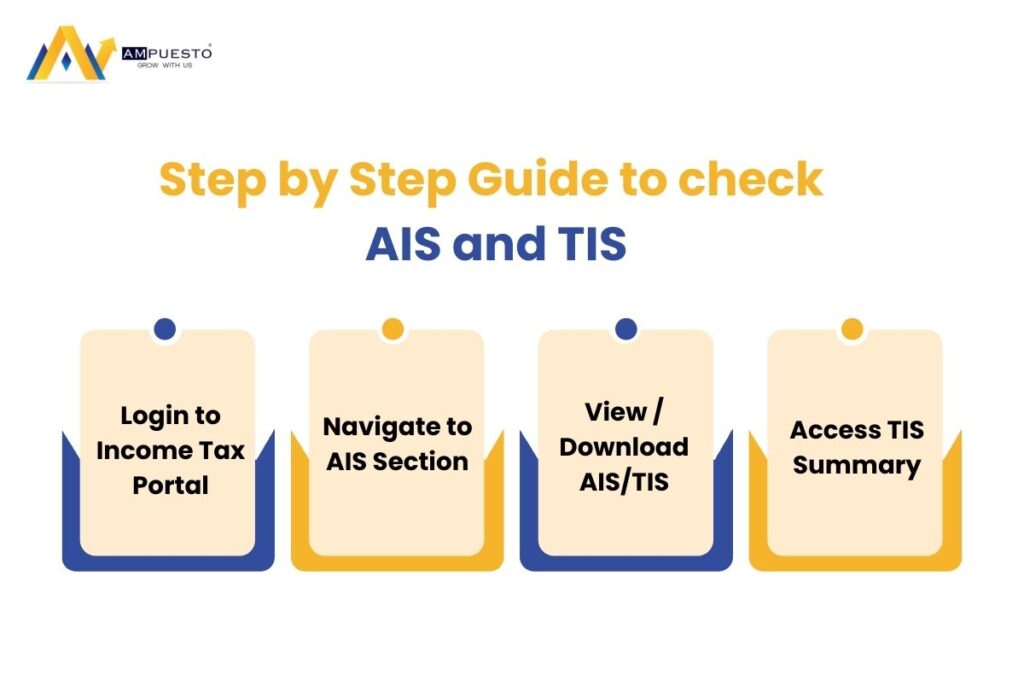

Step-by-Step Guide

1. Log in to the Income Tax Portal:

- Visit: https://www.incometax.gov.in/

- Enter your PAN, password, and captcha to log in.

2. Navigate to AIS Section:

- After logging in, go to the “Services” tab.

- Click on “Annual Information Statement (AIS).”

3. View or Download AIS/TIS:

- Select the relevant financial year.

- Choose to either view the document online or download it as a PDF.

4. Access TIS Summary:

- Within the AIS section, a summarized version of TIS will also be available for download.

Password to Open AIS and TIS

The downloaded AIS and TIS documents are password-protected for security reasons. To open them:

- The password is a combination of your PAN (in uppercase) and your date of birth (in DDMMYYYY format).

- Example: If your PAN is ABCDE1234F and your date of birth is 1st January 1985, the password will be ABCDE1234F01011985.

This security measure ensures that sensitive financial data is accessible only to the taxpayer.

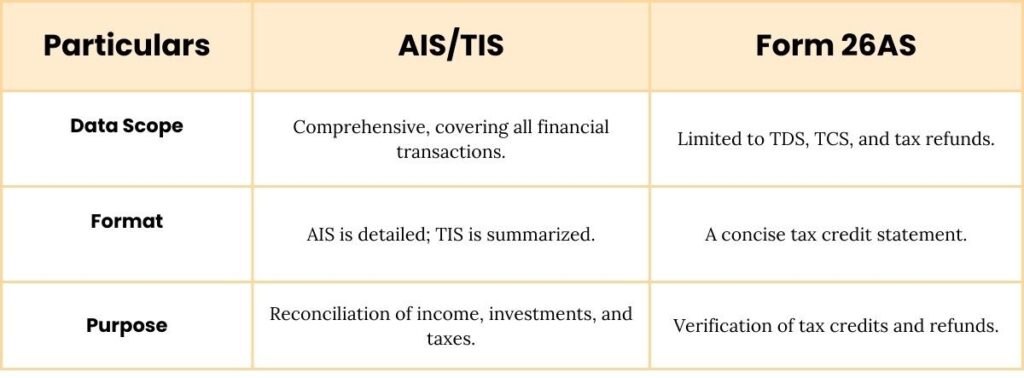

How It is Different from Form 26AS

While AIS and TIS provide detailed and summarized views of financial transactions, Form 26AS serves a slightly different purpose:

AIS and TIS are more inclusive, covering transactions like property sales, investments, and foreign remittances that are absent in Form 26AS.

How to Submit Feedback in AIS Query

If you notice discrepancies or errors in your AIS, you can submit feedback as follows:

1. Log in to the Income Tax Portal:

- Use your credentials to access your account.

2. Access the AIS Section:

- Navigate to the “Annual Information Statement (AIS)” page.

3. Select the Transaction:

- Identify the transaction you want to provide feedback for.

- Click on the feedback icon next to the entry.

4. Submit Feedback:

- Choose the appropriate feedback option (e.g., “Information is correct,” “Information is incorrect,” etc.).

- Provide additional comments if required and submit.

5. Monitor Status:

- The portal will update the status of your feedback once reviewed.

Practical Tips for Maximizing AIS and TIS

- Regular Monitoring: Download and review AIS regularly to track financial transactions and ensure consistency.

- Seek Expert Help: Consult tax professionals to reconcile AIS data with your own records.

- Use for Tax Planning: Analyze trends in TIS to identify areas for tax-saving investments.

By understanding and using AIS and TIS effectively, taxpayers can ensure accurate and hassle-free ITR filing. At AMpuesto, we’re here to guide you through every step of the process, ensuring your financial data aligns with tax compliance requirements.