When an auditor resigns from a company, the process isn’t as simple as sending a goodbye note and walking away. The law requires a formal disclosure, and that’s where Form ADT-3 comes in. It’s the official document an auditor must file to inform the Ministry of Corporate Affairs (MCA) about their resignation, the reason behind it, and the circumstances that led to it.

Let’s dive into the details to understand its significance and the process associated with it.

Meaning of Form ADT-3

Form ADT-3 is a statutory form mandated under Section 140(2) of the Companies Act, 2013, used by auditors to notify the Registrar of Companies (ROC) about their resignation from a company. This compliance measure ensures that companies maintain transparency in their financial operations and uphold corporate governance standards.

The law clearly states:

- An auditor who resigns must file ADT-3 within 30 days of resignation.

- The filing must clearly state reasons for resignation, relevant facts, and supporting details.

This ensures that both the company and the auditor are compliant with statutory requirements.

ADT-3 Form Purpose

The core purpose of Form ADT-3 is to maintain transparency. It provides the government with a clear picture of why the auditor left and whether the resignation impacts financial integrity.

In simple terms, ADT-3 helps track:

- Whether the auditor resigned due to disagreements

- Whether there were issues in the financial statements

- Whether the auditor found something that needed disclosure

- Whether it was a normal exit after internal or personal reasons

It protects the auditor, safeguards stakeholders, and reinforces accountability.

Who Must File Form ADT-3

Only the resigning auditor files ADT-3.

This applies to:

- Individual auditors

- Audit firms

- LLPs acting as auditors

- Auditors of both private and public companies

The company does not file this form. Its job is to fill the casual vacancy after the resignation.

When You Must File ADT-3

You have exactly 30 days from the date you submit your resignation letter to the company.

For example:

If an auditor resigns on 1st August, ADT-3 must be filed on or before 31st August.

Missing this deadline leads to penalties, so timing matters.

What You Need to Include in Form ADT-3 (Checklist)

Here is everything that ADT-3 requires:

- Corporate Identity Number (CIN)

- Name and registered address of the company

- Category of auditor (individual/firm/LLP)

- Membership number of the auditor

- PAN details

- Audit Firm Registration Number (if applicable)

- Date of appointment

- Date of resignation

- Detailed reason for resignation

- Any other relevant facts or disclosures

- Whether there were any disputes or concerns

- Digital Signature Certificate (DSC) of the auditor

ADT-3 documents required:

- Resignation letter

- Any supporting documents explaining the reason

- Board resolution (optional but recommended for transparency)

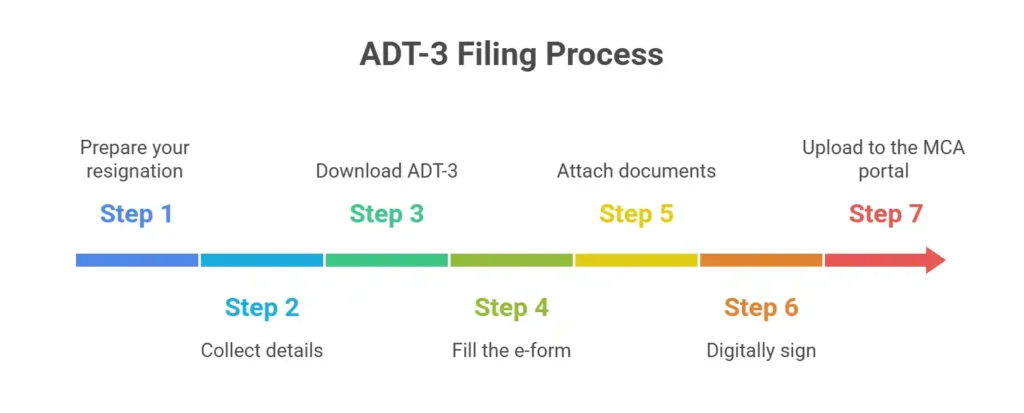

Step-by-Step Filing Process for ADT-3

To make the filing smooth, here’s a simple walkthrough:

Step 1: Prepare your resignation

Submit the resignation letter to the company. Keep an acknowledged copy for uploading.

Step 2: Collect details

CIN, auditor details, date of appointment, date of resignation, audit firm details, etc.

Step 3: Download ADT-3

Get the latest version from the MCA portal.

Step 4: Fill the e-form

Add accurate information and reasons for resignation. Avoid vague statements. Clear and factual is always safer.

Step 5: Attach documents

Upload the resignation letter and other relevant documents.

Step 6: Digitally sign

Sign the e-form with your DSC.

Step 7: Upload to the MCA portal

Submit the form, make payment if any, and download the acknowledgment.

Penalties for Not Filing ADT-3

Late filing or non-filing leads to penalties under Section 140(3):

- A fine starting from ₹50,000, or

- The auditor’s remuneration, whichever is less

- And a further penalty up to ₹500 per day for continuing default

Non-filing also puts the auditor at professional risk, as regulatory bodies may treat it as negligence.

What the Company Must Do After an Auditor Resigns

Once the auditor files ADT-3, the company has its own duties:

- Create a casual vacancy

- Appoint a new auditor

- File ADT-1 for the new appointment

- Update records and ensure continuity in audit work

Both parties must coordinate to avoid compliance gaps.

Common Reasons for Auditor Resignation

Auditor resignations can occur due to various reasons, and filing Form ADT-3 provides an opportunity to formally document these causes. Some common reasons include:

- Lack of Cooperation from Management: Instances where the company’s management or board does not provide sufficient support or access to financial records.

- Disagreements on Accounting Policies: Conflicts over the interpretation or application of accounting standards and policies.

- Professional Conflicts of Interest: Situations where the auditor’s independence or integrity may be compromised.

- Ethical Concerns: Concerns regarding ethical practices or adherence to regulatory requirements by the company.

Benefits of Timely Filing of ADT-3

1. Maintaining Transparency

Filing Form ADT-3 demonstrates the auditor’s commitment to transparency and accountability, reflecting positively on their professional conduct.

2. Legal Compliance

Timely filing ensures adherence to the Companies Act, 2013, protecting the auditor from penalties and legal complications.

3. Safeguarding Corporate Governance

By officially notifying the ROC, the filing of ADT-3 helps maintain robust corporate governance practices within the company.

Conclusion

ADT-3 isn’t just another compliance form. It’s a crucial document that ensures transparency when an auditor steps away from a company. Filing it on time, explaining the reasons clearly, and attaching the right documents keep both the auditor and the company safe from legal issues. When the process is followed properly, it maintains trust, clarity, and regulatory discipline – all of which are essential in corporate financial reporting.

Looking for expert guidance on corporate compliance and seamless filing processes? Trust AMpuesto to simplify your business needs today!

FAQs

Do all resignations need ADT-3?

Yes. Even if the resignation is for internal or personal reasons.

Can a company file ADT-3?

No. Only the auditor files it.

Does ADT-3 need a DSC?

Yes. Digital signature of the auditor is mandatory.

What if the auditor doesn’t file ADT-3?

They face penalties and professional repercussions.

Does ADT-3 apply to all companies?

Yes – private, public, section 8, small, listed – all companies covered under the Companies Act.