When your GST (Goods and Services Tax) registration gets canceled, it primarily implies that your taxpayer identification for GST, known as GSTIN, is no longer valid.

This can happen due to several reasons, includingnon-compliance with GST filing or other regulatory requirements. The repercussions of this cancellation can be significant and affect your business operations, tax obligations, and legal standing.

How Do I Get My Surrendered GST Number Back?

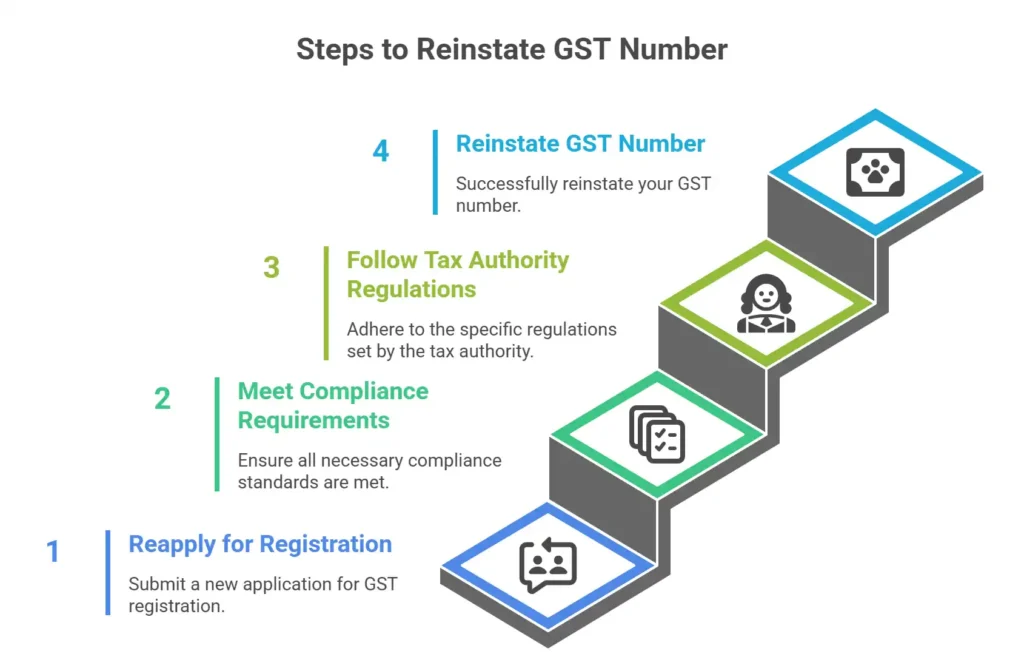

If you’ve willingly surrendered your GST number and wish to reinstate it, the process involves several steps. Generally, you’d need to reapply for GST registration, ensuring that all the compliance requirements are met. The reinstatement procedure might vary depending on the tax authority’s regulations and the grounds on which you surrendered the GST number initially.

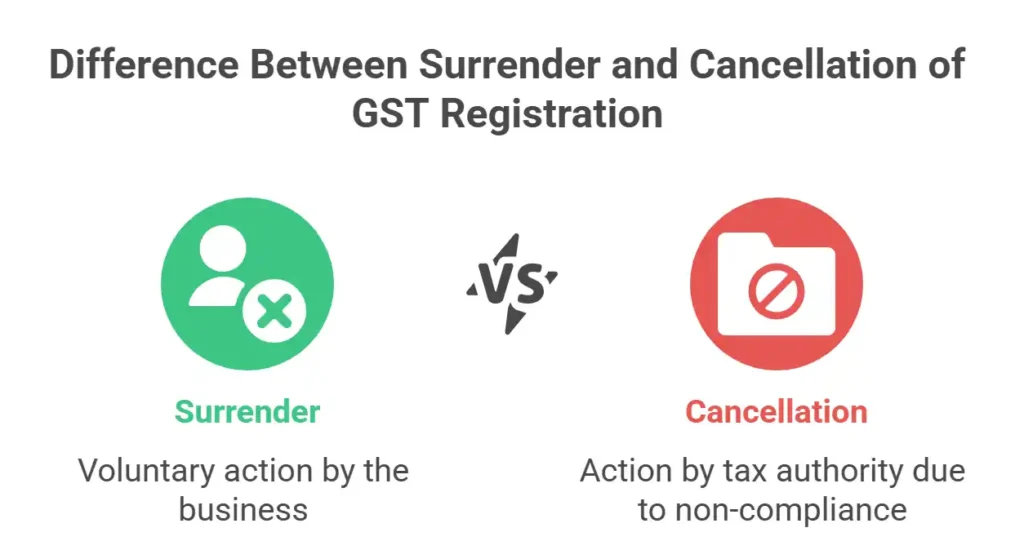

Understanding the Difference Between Surrender and Cancellation of GST Registration

The difference between surrender and cancellation of GST registration lies primarily in the initiator. When you surrender your GST number, it’s a voluntary action taken by you or your business, usually due to restructuring or ceasing certain operations. On the contrary, the cancellation of GST registration may occur due to non-compliance or regulatory issues, and it’s an action taken by the tax authority.

How Can I File for Cancellation of GST Registration?

Filing for the cancellation of your GST registration involves a formal process. This often includes submitting requisite documents, clearing any outstanding dues, and adhering to the guidelines provided by the tax authority. The process might differ based on whether it’s voluntary cancellation or enforced by the tax department.

This informative article aims to guide taxpayers through the complexities of GST registration cancellation or surrender, offering insights into crucial aspects and providing step-by-step instructions for managing these situations effectively.

Importance of GST Registration

GST registration is pivotal for businesses to comply with tax laws and gain access to input tax credit (ITC). It enables the legal recognition of an entity as a GST-registered taxpayer, facilitating smooth business transactions and adherence to taxation regulations.

What Triggers GST Cancellation?

GST cancellation may be triggered by various factors, such as non-compliance with filing returns, failure to furnish financial documents, or non-payment of taxes within the stipulated time frames. Additionally, voluntary cancellation initiated by the taxpayer can occur due to business restructuring or discontinuation.

Ramifications of Cancelled GST Registration

When your GST registration is canceled, it can result in severe consequences. These consequences might include tax penalties, legal repercussions, and restrictions on conducting business activities until the registration is reinstated or resolved.

Repercussions of a Surrendered GST Number

Surrendering a GST number can affect your business in multiple ways. It might lead to alterations in tax liabilities, business operations, and compliance requirements. Understanding the implications before surrendering a GST number is crucial for seamless transitions.

Process to Reinstate a Cancelled GSTIN

Reinstating a canceled GSTIN involves a systematic approach. It typically requires reapplying for registration, addressing any compliance gaps, and fulfilling the criteria set by the tax authority for reinstatement.

Retrieving a Surrendered GST Number

If you wish to regain a GST number that was previously surrendered, the process involves reapplying for registration and fulfilling the compliance requirements. The steps and prerequisites may differ based on the tax regulations.

Conclusion

In conclusion, managing the process of GST registration cancellation or surrender necessitates a thorough understanding of the legal, financial, and operational implications. Adhering to compliance, seeking expert advice when needed, and strategizing for post-cancellation/surrender scenarios are vital for businesses.

FAQs

Is GST registration cancellation the same as surrendering GSTIN?

No, there’s a significant difference. Surrendering GSTIN is a voluntary action initiated by the taxpayer, whereas cancellation might be enforced by the tax authority due to non-compliance.

Can I reinstate a canceled GST registration?

Yes, you can reinstate a canceled GST registration by following the reinstatement procedures outlined by the tax authority.

How long does it take to reinstate a canceled GSTIN?

The timeframe for reinstating a canceled GSTIN varies, and it depends on several factors, including compliance fulfillment and processing times by the tax authority.

What happens to pending tax liabilities after GST registration cancellation?

Clearing pending tax liabilities is crucial before cancellation. Failure to do so might lead to complications and legal repercussions.

Is legal counsel necessary for handling GST registration cancellation or surrender?

While not mandatory, engaging legal counsel or seeking expert advice can provide clarity on legal implications and ensure compliance with regulations.

Can proactive tax planning help avoid GST registration cancellation or surrender?

Yes, proactive tax planning, adherence to compliance, and staying updated with regulations can prevent situations leading to cancellation or surrender.