In the digital age, social media has transformed from a mere platform for personal expression to a lucrative career opportunity for many. As influencers carve out a niche in this dynamic industry, they face unique financial considerations, particularly in terms of taxation.

The rise of social media influencers has caught the attention of tax authorities worldwide, leading to specific regulations regarding Income Tax and Goods and Services Tax (GST). Understanding these tax implications is crucial for influencers to ensure compliance and optimize their financial management.

This blog delves into the intricate world of taxation for social media influencers, shedding light on how income tax and GST affect their earnings and operational practices.

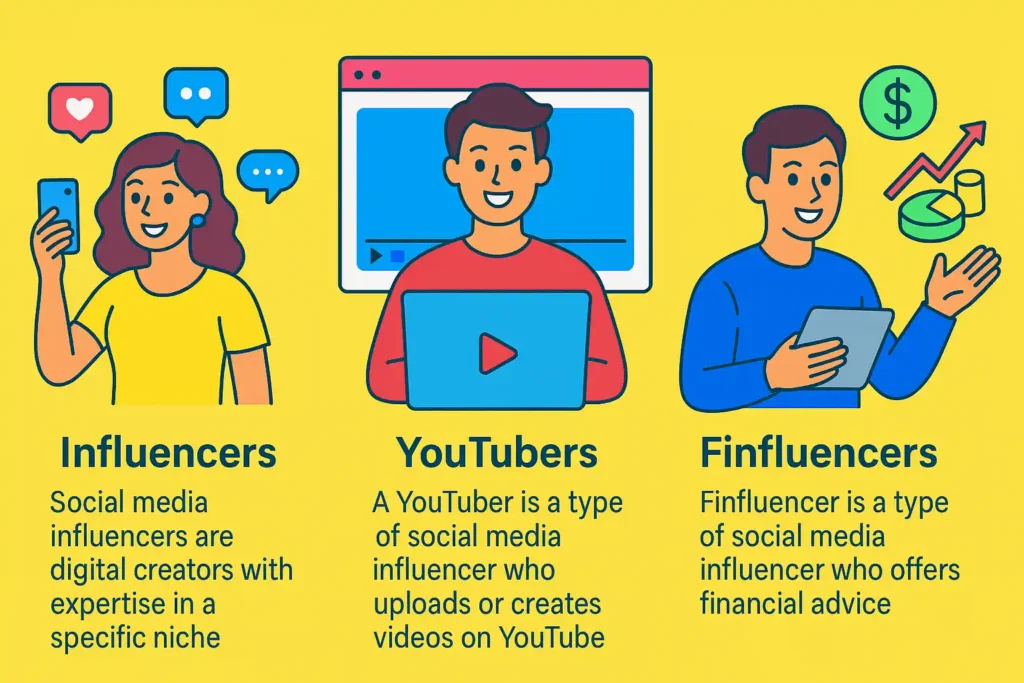

Who are YouTubers, Influencers, and Finfluencers?

Influencers – Social media influencers are digital creators with expertise in a specific niche. Social media influencers share content they’re passionate about, build and engage with an audience of their followers, and collaborate with different brands.

YouTubers – A YouTuber is a type of social media influencer who uploads or creates videos on the online video-sharing website YouTube, posting videos to their personal YouTube channel.

Finfluencers – Finfluencer is also a type of social media influencer; these are individuals with a significant presence on social media platforms who offer financial advice, share personal experiences related to money management, and discuss various investment topics.

How do these People Make Money?

1. AdSense – YouTubers, Influencers, and Finfluencers make money from Google AdSense, but mainly YouTubers earn money from this by posting their videos on YouTube or such related platforms.

2. Brand collaboration – YouTubers, Influencers, and Finfluencers make money by collaborating with brands.

3. Selling merchandise – YouTubers, Influencers, and Finfluencers make money by selling their name or their famous dialogue merchandise.

4. Events – YouTubers, Influencers, and Finfluencers also make money by doing public events and sponsored events.

GST needed for YouTubers, Influencers, and Finfluencers?

As specified under the GST Act, any person whose annual revenue crosses Rs 20 lakhs (Rs 10 lakhs in some states) by providing services is required to have GST registration. If your annual turnover is less than Rs. 20 lakhs, then it’s not compulsory to have GST registration, but you can register voluntarily.

As youtubers are exporting a service by creating and posting videos on YouTube platform so here the supplier is the youtuber and the recipients are viewers who are watching those videos on YouTube and its head office is situated outside of India, the payment is received in exchangeable foreign currency and the supplier is located in India, so it will be considered as export of service.

Indian government has made exports tax-exempt (some specified exports are taxed), and this service falls under the exempted section, so YouTubers don’t need to pay any GST for income received from YouTube or such platforms, but to be tax-exempt, you need to furnish LUT (Letter of Undertaking).

Same for influencers and finfluencers, as they also make videos on YouTube and such other platforms, qualifying the exports statement said in the GST Act, influencers and finfluencers also don’t have to pay any GST on income from YouTube or such other platforms. Now a question arises, ‘Are all the incomes exempted from GST?’

Well, no, all the incomes of YouTubers, Influencers, and Finfluencers are not exempted. Only the income from the export of services is exempted, but if you provide any services to any business in India, then you will have to pay tax accordingly. All the B2B or B2C invoices made to recipients in India will be liable to be taxed under GST.

Income Tax for YouTubers, Influencers, and Finfluencers

Youtubers, Influencers, and Finfluencers’ income from YouTube or such other platform is considered as business income. Income from Youtube or such other related platform are taxed as per normal tax slab rate in India, they also have an option to Opt section 44AD of income tax act in which if your annual turnover is less than 3 cr, then 6% of your total turnover or actual income whichever is higher will be considered as your net income and you will be taxed on that income.

Point to note here is that once you opt for 44AD, then you have to continue that for 5 years. If you change back to the normal taxation system, then you can’t opt for 44AD again for 5 years. If you don’t opt for 44AD, then you will be taxed normally; your whole income less your expenses will be your net income, and that will be taxed according to the tax slab rate.