India’s digital commerce ecosystem has expanded at an unprecedented pace. Platforms like Amazon, Flipkart, Meesho, Swiggy, and Zomato have enabled sellers and service providers to access customers across India without setting up physical infrastructure.

But here’s the thing: GST treatment for e-commerce differs significantly from traditional trade. The law introduces additional compliance layers, special collection mechanisms, and even liability shifts in specific cases.

This guide breaks down:

- TCS under Section 52

- Liability shift under Section 9(5)

- Compliance responsibilities of operators and sellers

- Practical illustrations

- Key differences that businesses often misunderstand

Meaning of E-Commerce Under GST

As per Section 2(44) of the CGST Act:

Electronic commerce means the supply of goods or services or both, including digital products, over a digital or electronic network.

This covers:

- Marketplace models

- Aggregator platforms

- Inventory-led online businesses

- App-based service models

In simple terms, if a digital platform facilitates a supply, GST provisions for e-commerce may apply.

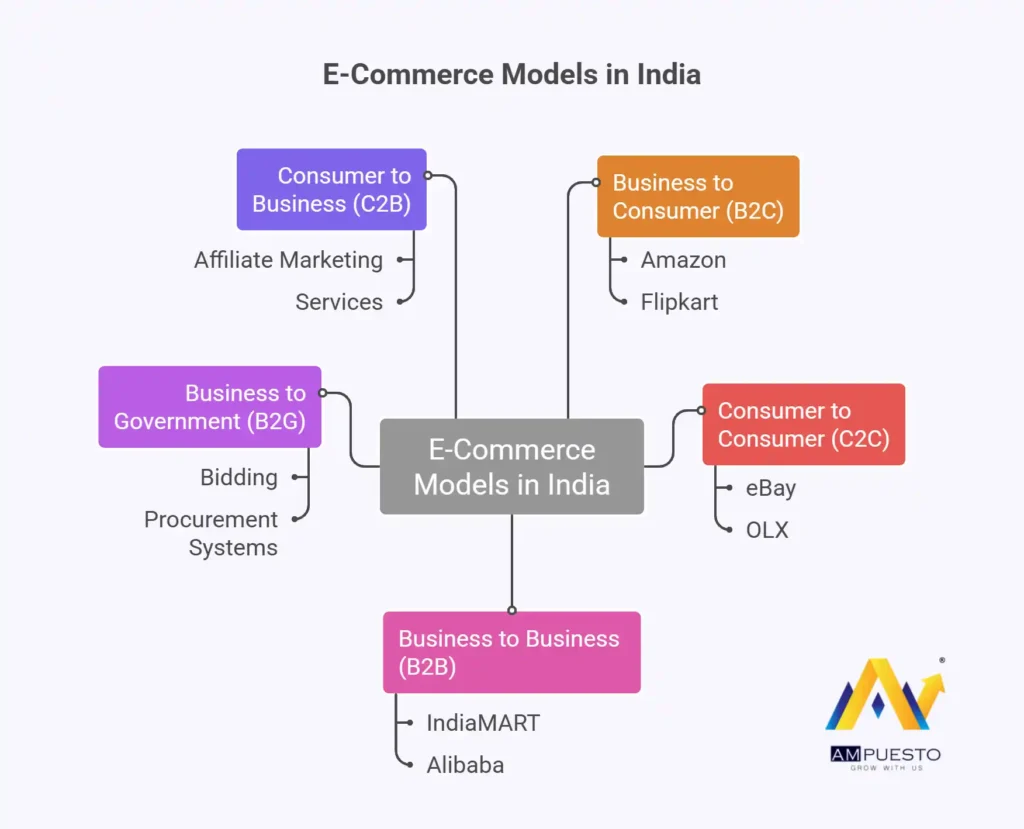

Types of E-Commerce Models in India

Understanding the structure helps determine GST implications.

1. Business to Consumer (B2C)

Businesses sell directly to end consumers.

Examples: Amazon, Flipkart

2. Consumer to Consumer (C2C)

Consumers sell goods or services to other consumers.

Examples: eBay, OLX

3. Business to Business (B2B)

Businesses sell to other businesses for commercial use or resale.

Examples: IndiaMART, Alibaba

4. Business to Government (B2G)

Businesses supply goods or services to government departments through bidding or procurement systems.

5. Consumer to Business (C2B)

Consumers offer services or products to businesses. Affiliate marketing platforms fall under this category.

Each model may trigger different GST compliance requirements depending on how the platform operates.

Who is an E-Commerce Operator (ECO)?

Under Section 2(45) of the CGST Act:

An E-Commerce Operator (ECO) means any person who owns, operates, or manages a digital platform for electronic commerce.

An ECO may facilitate supply without owning the goods or services.

Common examples include:

- Marketplace platforms

- Cab aggregators

- Food delivery apps

- Online accommodation booking platforms

Tax Collection at Source (TCS) Under Section 52

One of the most critical aspects of GST for e-commerce is TCS.

What is TCS Under GST?

TCS is a mechanism where the E-Commerce Operator collects a small percentage of tax from payments due to suppliers and deposits it with the Government.

Important:

TCS is not an additional tax. It functions as an advance tax collection system.

TCS applies once supply occurs through the platform and the operator collects consideration on behalf of the supplier. Even if the operator receives payment later, liability arises in the month of supply.

TCS does not apply to exempt supplies.

TCS Rate

- 1% (0.5% CGST + 0.5% SGST) for intra-state supplies

- 1% IGST for inter-state supplies

The rate applies to the net value of taxable supplies.

Meaning of Net Value

Net Value = Taxable supplies made through the ECO (-) Supplies returned during the month

Practical Example – TCS Calculation

A seller sells goods worth ₹1,00,000 through Amazon.

1. Customer pays ₹1,00,000 to the platform

2. Platform deducts 1% TCS = ₹1,000

3. Seller receives ₹99,000

4. Platform deposits ₹1,000 with the Government

The seller can claim ₹1,000 in the Electronic Cash Ledger and use it to discharge GST liability.

Compliance Responsibilities of E-Commerce Operators

An ECO must:

- Collect TCS on applicable supplies

- Deposit TCS within the prescribed due date

- File the monthly return in Form GSTR-8 by the 10th of the following month

- Report accurate supply details for each seller

The details filed in GSTR-8 reflect in the supplier’s GST portal for reconciliation.

If notified, the ECO must also file an annual statement.

Accuracy matters. Any mismatch between platform reporting and seller returns may trigger notices.

Compliance Responsibilities of Sellers

Sellers operating through e-commerce platforms must:

- Obtain GST registration (mandatory in most cases, regardless of turnover)

- Reconcile GSTR-8 data with the books of accounts

- Match turnover with GSTR-1 and GSTR-3B

- Properly utilize TCS reflected in the Electronic Cash Ledger

- Reconcile ITC with GSTR-2A / GSTR-2B

Regular reconciliation reduces litigation risk and prevents future tax demands.

Section 9(5) – Shift of GST Liability

This provision creates the biggest confusion in e-commerce taxation.

What is Section 9(5)?

The Government may notify specific services where the E-Commerce Operator, not the actual supplier, must pay GST.

In such cases:

- The ECO becomes the deemed supplier

- The actual service provider does not pay GST on that supply

- TCS does not apply

Services Covered Under Section 9(5)

Currently notified services include:

1. Passenger transport services (cab aggregators like Uber)

2. Restaurant services supplied through ECO

3. Certain accommodation services

4. Housekeeping services

If a restaurant supplies food through Swiggy, the platform pays GST under Section 9(5).

Key Consequences Under Section 9(5)

- ECO issues the tax invoice

- Supplier does not charge GST

- No TCS deduction

- Supplier excludes such turnover for GST liability purposes

TCS vs Section 9(5) – Clear Comparison

| Particular | Section 52 (TCS) | Section 9(5) |

|---|---|---|

| Nature | Tax collection mechanism | Liability shift provision |

| Who pays GST | Seller | ECO |

| TCS applicable | Yes | No |

| Who issues the invoice | Seller | ECO |

| Supplier liable | Yes | No |

Understanding this distinction prevents major compliance errors.

Key Takeaways for E-Commerce Businesses

GST compliance in e-commerce runs on three core pillars:

1. Compulsory registration provisions

2. TCS under Section 52

3. Liability shift under Section 9(5)

Businesses that maintain clean reconciliation between books, GSTR-1, GSTR-3B, and GSTR-8 avoid most departmental disputes.

What this really means is simple:

E-commerce offers scale, but GST demands precision.

If you operate through digital platforms, treat compliance as a structured monthly discipline, not an afterthought.

FAQs

Yes. Since the operator is treated as the deemed supplier under Section 9(5), it can claim ITC on eligible inputs and input services used to provide those notified services, subject to normal ITC conditions.

Failure to collect or deposit TCS may attract interest, penalties, and recovery proceedings under the GST law. The operator remains liable for compliance even if the supplier has paid GST separately.

No. TCS applies only when the e-commerce operator collects consideration on behalf of the supplier. If payment is made directly to the seller, TCS provisions do not apply.

If goods are returned in a subsequent month, an adjustment is made while calculating net taxable supplies in that month. Excess TCS reflected in the Electronic Cash Ledger can be used to offset future GST liabilities.