In the world of business and finance, staying compliant with regulatory requirements is essential for smooth operations. One such requirement for companies registered under the Ministry of Corporate Affairs (MCA) in India is filing Form AOC 4. This form pertains to the financial statements and annual reports of a company and plays a crucial role in maintaining transparency and accountability. In this comprehensive guide, we will walk you through the process of Form AOC 4 filing, including due dates and associated fees.

Introduction to Form AOC 4 Filing

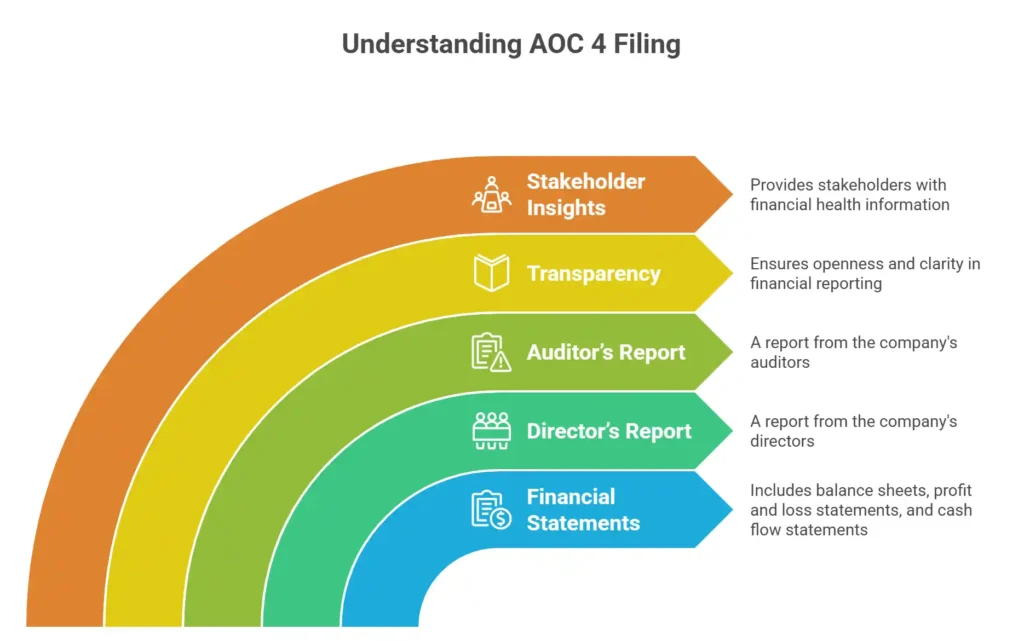

Form AOC 4, as prescribed by the Ministry of Corporate Affairs, requires companies to submit their financial statements, including balance sheets, profit and loss statements, and cash flow statements, along with the Director’s Report and Auditor’s Report. This annual filing is applicable to all companies registered under the Companies Act, 2013. Its primary objective is to ensure transparency and provide stakeholders with insights into a company’s financial health.

Understanding the Significance

The Form AOC 4 filing is not just a regulatory obligation; it’s a way for companies to communicate their financial performance to shareholders, creditors, and other stakeholders. By making this information accessible, the MCA aims to promote trust in the corporate sector and enhance corporate governance.

Step-by-Step Guide to Form AOC 4 Filing

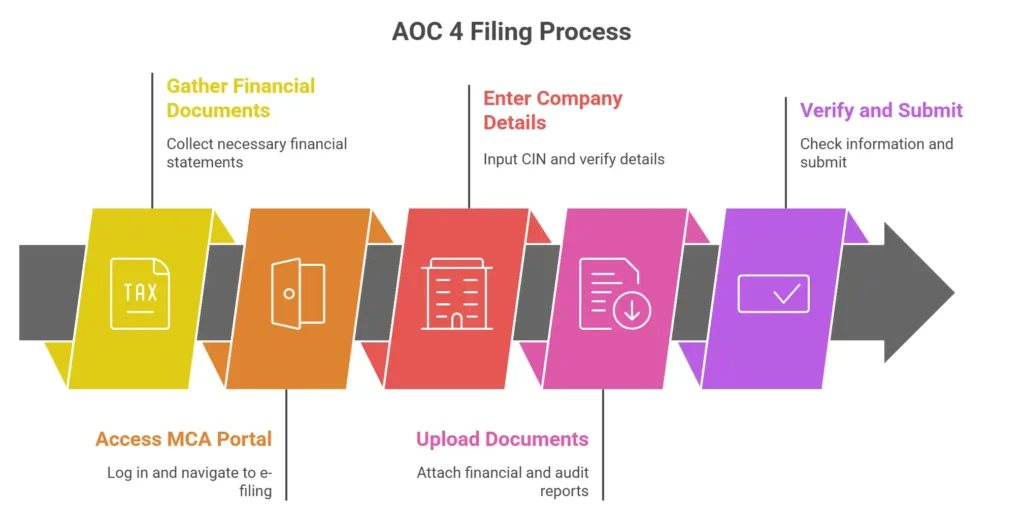

1. Gathering Financial Information

Before you begin, gather all relevant financial documents, including the balance sheet, profit and loss statement, and cash flow statement for the fiscal year.

2. Accessing the MCA Portal

- Visit the official MCA portal and log in using your credentials.

- From the dashboard, navigate to the ‘E-filing’ tab and select ‘File AOC 4.’

3. Filling in Company Details

- Enter the company’s Corporate Identification Number (CIN).

- The system will auto-fill the company’s basic details. Verify and update if necessary.

4. Uploading Financial Documents

- Attach the prepared financial statements.

- Attach the Director’s Report and Auditor’s Report as well.

5. Verifying Information and Submitting

- Double-check all entered information for accuracy.

- 2. Click ‘Submit.’ You will receive an acknowledgment indicating successful submission.

Importance of Timely Filing

Filing Form AOC 4 within the stipulated time is crucial. It prevents penalties and legal hassles, maintains good corporate standing, and fosters credibility among stakeholders.

Consequences of Non-Compliance

Failure to file Form AOC 4 or filing it inaccurately can lead to severe penalties, suspension of company operations, and even disqualification of directors.

Due Dates and Extension Possibilities

Normal Due Date

The normal due date for Form AOC 4 filing is within 30 days from the date of the Annual General Meeting (AGM).

Extension Scenarios

Under certain circumstances, companies can apply for an extension of the filing deadline. Valid reasons include unforeseen events, technical glitches, or legal constraints.

Fee Structure for Form AOC 4

The filing fees for Form AOC 4 depend on the company’s authorized share capital. It’s important to refer to the official MCA fee structure for accurate information.

Expert Tips for Seamless Filing

- Start the preparation process early to avoid last-minute hassles.

- Keep your financial records organized and updated.

- Consult with financial experts or legal advisors if needed.

Comparing Physical and Online Filing

While physical filing was the norm earlier, online filing through the MCA portal has streamlined the process, making it quicker and more efficient.

Common Challenges Faced

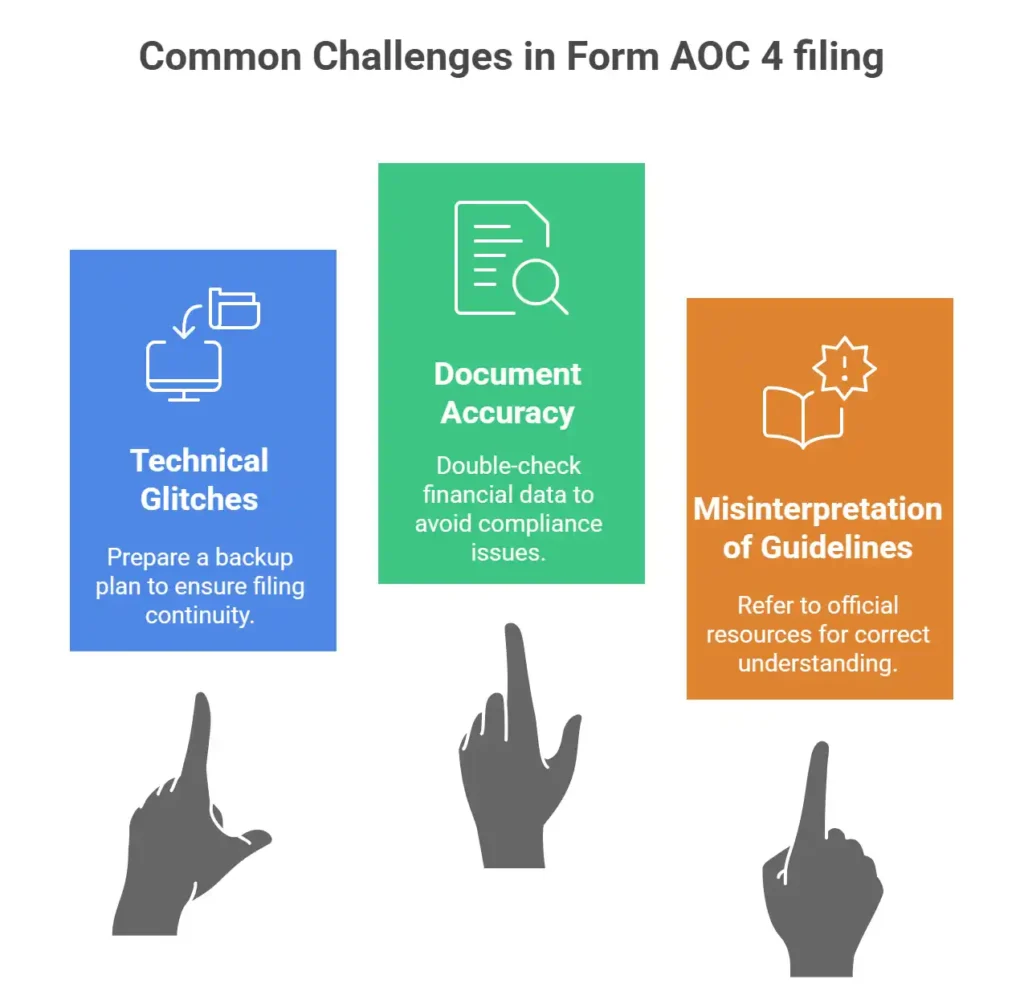

1. Technical Glitches

Online filing might encounter technical issues. It’s advisable to have a backup plan ready.

2. Document Accuracy

Inaccurate financial data can lead to compliance issues. Double-check all entered information.

3. Misinterpretation of Guidelines

Misunderstanding MCA guidelines can result in incorrect filing. Always refer to official resources.

Conclusion

In conclusion, Form AOC 4 filing is a crucial aspect of maintaining transparency and accountability in the corporate world. By adhering to the process outlined in this guide, companies can fulfill their regulatory obligations, gain stakeholder trust, and contribute to the overall growth of the business landscape.

Frequently Asked Questions (FAQs)

Can the Form AOC 4 filing deadline be extended beyond the stipulated time?

Yes, under specific circumstances, companies can apply for an extension citing valid reasons.

Are there any consequences for filing Form AOC 4 late?

Yes, late filing can result in monetary penalties and legal complications.

Is it possible to make changes to the filed Form AOC 4?

Yes, you can make corrections by filing Form AOC 4 again with accurate details

What is the purpose of submitting the Director’s Report along with the financial statements?

The Director’s Report provides insights into the company’s performance, operations, and future plans.

Where can I seek assistance if I face technical issues during online filing?

You can reach out to the MCA helpline or technical support for guidance.