India’s business ecosystem is vast, fast-moving, and opportunity-rich. A large young population, strong domestic consumption, and growth across technology, manufacturing, and services have made India the world’s third-largest consumer market and the fourth-largest economy.

But with opportunity comes responsibility.

From local kirana stores to multinational corporations, Indian businesses are governed by multiple laws, including the Income Tax Act, Companies Act, 2013, Central Goods and Services Tax Act, 2017, Consumer Protection Act, 2019, and more. Even small compliance gaps or delayed actions can trigger penalties, interest, late fees, and avoidable scrutiny.

In this guide, we break down the most common compliance mistakes Indian businesses make and explain how to avoid them so operations stay smooth, compliant, and penalty-free.

7 Most Common Compliance Mistakes Indian Businesses Make

1. Not Understanding the Nature of Your Business and Applicable Laws

One of the most fundamental mistakes businesses make is failing to understand which laws apply to their business structure.

- Companies must comply with the Companies Act, 2013. Directors are expected to understand their statutory duties and filing obligations.

- LLPs are governed by the Limited Liability Partnership Act, 2008, which has its own compliance framework.

- Sole proprietors are primarily governed by the Income Tax Act, 1961, and the CGST Act, 2017, depending on turnover and business activity.

Misidentifying applicable laws often leads to missed filings, incorrect disclosures, and penalties that could have been easily avoided.

2. GST Compliance Mistakes That Frequently Trigger Penalties

a) Delay or Failure in GST Registration

If a business crosses the GST threshold limit or becomes liable under Sections 22, 24, or 25 of the CGST Act, 2017, GST registration must be obtained within 30 days.

Delays or failure to register invite penalties and interest. In GST law, even a short delay can quickly escalate into costly non-compliance.

b) Delay in Filing GST Returns

Returns such as GSTR-1, GSTR-3B, GSTR-4, and GSTR-9 must be filed on time- monthly, quarterly, or annually as applicable.

Late filing leads to:

- Late fees

- Interest liability

- Blocking of e-way bills

- Compliance rating issues

Routine delays are one of the most common reasons businesses face GST notices.

c) Not Updating Core and Non-Core Details on the GST Portal

Changes in business details must be updated promptly on the GST portal, including:

- Address

- Mobile number and official email ID

- Authorised signatory

- Changes in Memorandum of Association (for companies)

Failure to update these details can cause mismatches between the GST registration certificate and actual business information, increasing compliance risk.

d) Mismatch Between Turnover and Tax Details

Differences between figures reported in GSTR-1 and GSTR-3B are closely monitored.

Example:

- Sales as per GSTR-1 (December): ₹16,07,890

- Sales as per GSTR-3B: ₹15,97,890

Even small mismatches can create discrepancies between tax due and tax paid, leading to notices and reconciliation issues. Regular cross-checks are essential.

3. Ignoring Applicability of TDS and TCS Provisions

Many businesses release payments without checking whether TDS or TCS provisions apply.

Transactions such as:

- Professional fees

- Contractor payments

- Rent

- Commission

- Purchase of goods

may attract TDS or TCS under the Income Tax Act.

Failure to deduct or collect tax at the prescribed rate can result in:

- Interest

- Penalties

- Disallowance of expenses during assessment

Often, businesses realize this only after receiving notices from the Income Tax Department.

4. Ignoring or Delaying Responses to Government Notices

Ignoring notices from departments such as:

- Income Tax

- GST

- MCA

- Other regulatory authorities

is one of the most dangerous compliance mistakes.

Delayed or non-responses can lead to:

- Penalties and interest

- Summons or inspections

- Departmental scrutiny

- Perception of non-cooperation or concealment

Any notice, order, or query should be addressed immediately with professional assistance.

5. Inconsistency Across Government Portals

Businesses must maintain consistent information across portals such as:

- GST Portal

- Income Tax Portal

- MCA Portal

- Udyam Portal

Key details like turnover, income, address, nature of business, and bank accounts must match everywhere.

Example:

- Income as per AIS/TIS: ₹40,53,670

- Turnover reported in GSTR-3B: ₹38,24,570

Such mismatches may be treated as suppression of turnover and can invite penalties under Section 122 of the CGST Act, 2017.

6. Maintaining Books Without Edit-Log Enabled Software

Using accounting or ERP software without edit-log functionality is a serious compliance risk.

When entries can be edited or deleted without a trail, the authenticity of records becomes questionable during audits or assessments. This raises red flags and weakens the business’s position during scrutiny.

7. Non-Maintenance of Proper Documentation

Failure to maintain essential records, such as:

- Tax invoices

- E-way bills

- Delivery challans

- Purchase invoices

- Expense vouchers

can create serious problems during assessments or investigations.

Records and backups must generally be preserved for 6–8 years. Missing documentation often leads to adverse findings and penalties.

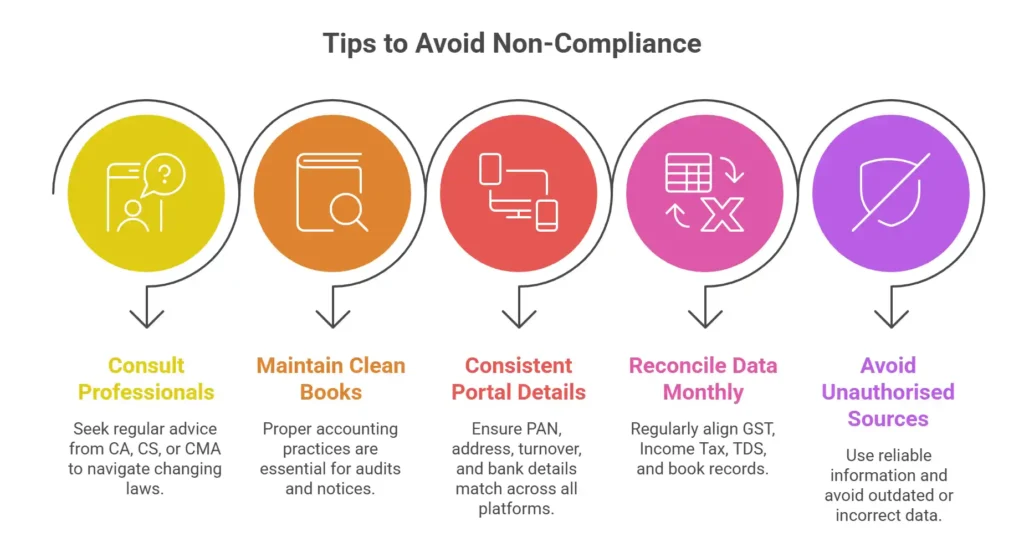

Practical Tips to Avoid Non-Compliance

1. Consult a CA, CS, or CMA regularly

Laws change frequently. Professional guidance helps prevent costly mistakes.

2. Maintain clean books of accounts

Proper accounting is your first line of defence during audits or notices.

3. Keep portal details consistent

PAN, address, turnover, and bank details must match everywhere.

4. Reconcile data monthly

GST, Income Tax, TDS, and books should always align.

5. Avoid unauthorised sources and assumptions

Outdated or incorrect information can push your business into non-compliance.

Compliance is not just paperwork. It is your business’s shield against penalties, disruptions, and reputational damage.

FAQs

Delays in GST registration, late return filing, ignoring notices, TDS/TCS non-compliance, and data mismatches across portals.

Yes. Even minor differences between GSTR-1 and GSTR-3B can trigger notices and reconciliation demands.

Non-response can lead to penalties, interest, summons, inspections, and prolonged scrutiny.

Yes. Registration must be obtained within 30 days of becoming liable.

Most systems are interconnected. Mismatches raise red flags and can result in penalties.

Yes. Frequent law changes make professional guidance essential to avoid costly errors.