In the realm of modern business operations, the role of a Chief Financial Officer (CFO) has undergone a significant transformation. The traditional CFO functions have evolved beyond financial stewardship and have now become more dynamic, adaptive, and accessible through CFO as a Service (CFOaaS) solutions. Embracing this shift means leveraging expertise on demand, redefining financial strategies, and empowering businesses to thrive in today’s ever-changing landscape.

Understanding CFO as a Service (CFOaaS)

CFO as a Service (CFOaaS) is a contemporary approach that allows businesses to access top-tier financial expertise without the need for a full-time CFO. It provides a spectrum of financial services tailored to the specific needs of an organization, ranging from financial analysis to strategic planning.

The Evolution of CFO Services

Traditionally confined to overseeing financial matters, the role of a CFO has metamorphosed into a strategic partner involved in critical decision-making. With the evolution of technology and business demands, CFOs now play a pivotal role in steering organizations toward sustainable growth.

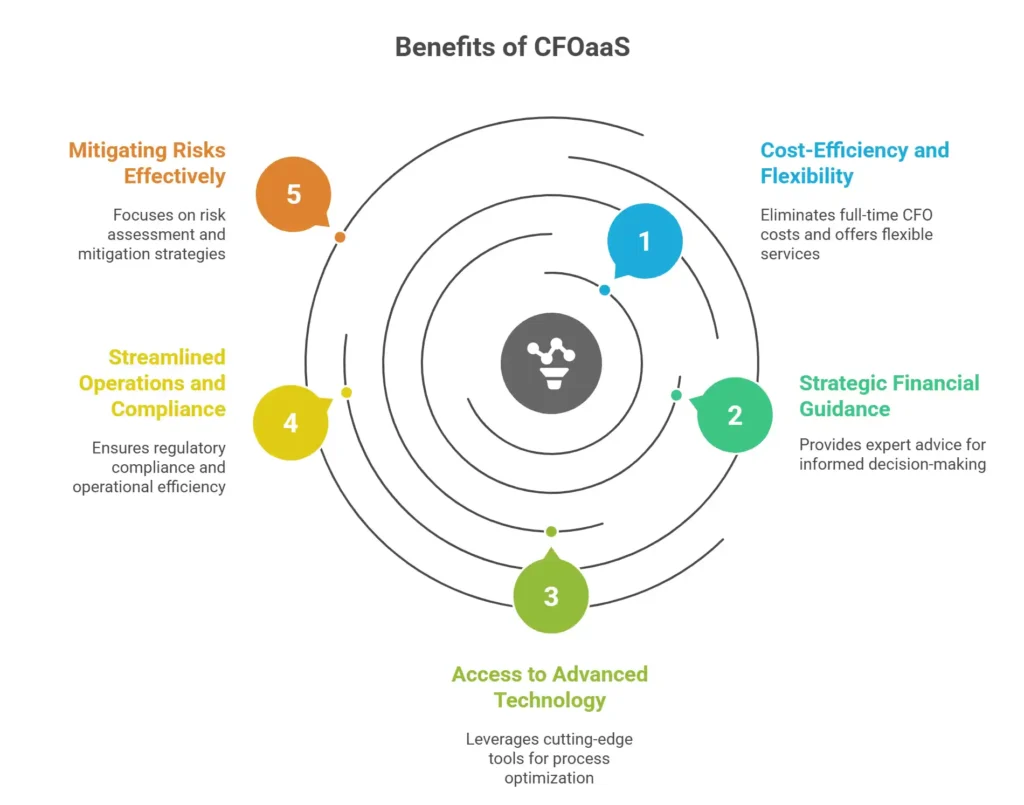

Advantages of Embracing CFOaaS

1. Cost-Efficiency and Flexibility

CFOaaS offers cost-efficient solutions by eliminating the need for a full-time CFO position. Businesses can access expert financial guidance and services as required, allowing for flexibility in operations.

2. Strategic Financial Guidance

Through CFOaaS, companies gain access to strategic financial advice and planning. This enables them to make well-informed decisions and navigate complex financial landscapes effectively.

3. Access to Advanced Technology

Embracing CFOaaS often includes leveraging cutting-edge financial technology. This access empowers businesses to streamline financial processes, enhance accuracy, and derive deeper insights from data.

4. Streamlined Operations and Compliance

CFOaaS aids in ensuring regulatory compliance and optimizing operational efficiency. Expertise in risk management and compliance helps in maintaining the integrity of financial operations.

5. Mitigating Risks Effectively

With a dedicated focus on risk assessment and mitigation strategies, CFOaaS helps organizations anticipate and address potential risks, fostering resilience and stability.

Implementing CFOaaS Successfully

To implement CFOaaS effectively, businesses should conduct a thorough assessment of their financial needs, select a suitable service provider, and establish clear communication channels for seamless collaboration.

Future Trends in CFO Services

The future landscape of CFO services is poised to witness further integration of artificial intelligence (AI), data analytics, and machine learning. These advancements will continue to revolutionize financial management, empowering CFOs to make data-driven decisions swiftly.

Conclusion

In conclusion, embracing CFO as a Service (CFOaaS) is not just a trend; it’s a strategic move that empowers businesses to thrive in the ever-evolving financial landscape. By accessing top-tier financial expertise on-demand, organizations can streamline operations, mitigate risks effectively, and make informed decisions.

Frequently Asked Questions (FAQs)

1. What is CFO as a Service (CFOaaS)?

CFOaaS is a modern approach that provides businesses with access to high-level financial expertise and services without the necessity of employing a full-time Chief Financial Officer.

2. How does CFOaaS differ from traditional CFO roles?

CFOaaS offers businesses the flexibility to access financial services as needed, without the commitment of a full-time executive. Traditional CFO roles involve a permanent position within the company.

3. What are the primary benefits of adopting CFOaaS?

The key advantages include cost-efficiency, strategic financial guidance, access to advanced technology, streamlined operations, and effective risk mitigation.

4. How can businesses successfully implement CFOaaS?

Successful implementation involves assessing financial needs, choosing a suitable service provider, and establishing clear communication channels for collaboration.