Section 122 of CGST Act prescribes monetary penalties for specified GST offences, including fake invoicing, wrongful ITC claims, non-registration, tax collection defaults, and documentation failures. The penalty can range from ₹10,000 to 100% of the tax involved, depending on whether fraud or suppression is established.

Whenever a GST notice mentions “Section 122,” taxpayers often assume serious fraud. That’s not always the case. This provision covers both procedural non-compliance and deliberate tax evasion. The penalty framework depends on the nature, gravity, and intention behind the default.

This guide explains Section 122 in practical terms.

What is Section 122 of CGST Act?

Under the Central Goods and Services Tax Act, 2017, Section 122 provides for monetary penalties where a person commits specific offences listed in the provision.

In simple terms:

If a person contravenes certain GST provisions, a penalty may be imposed in addition to tax and interest, subject to adjudication proceedings under Section 73 or Section 74, as applicable.

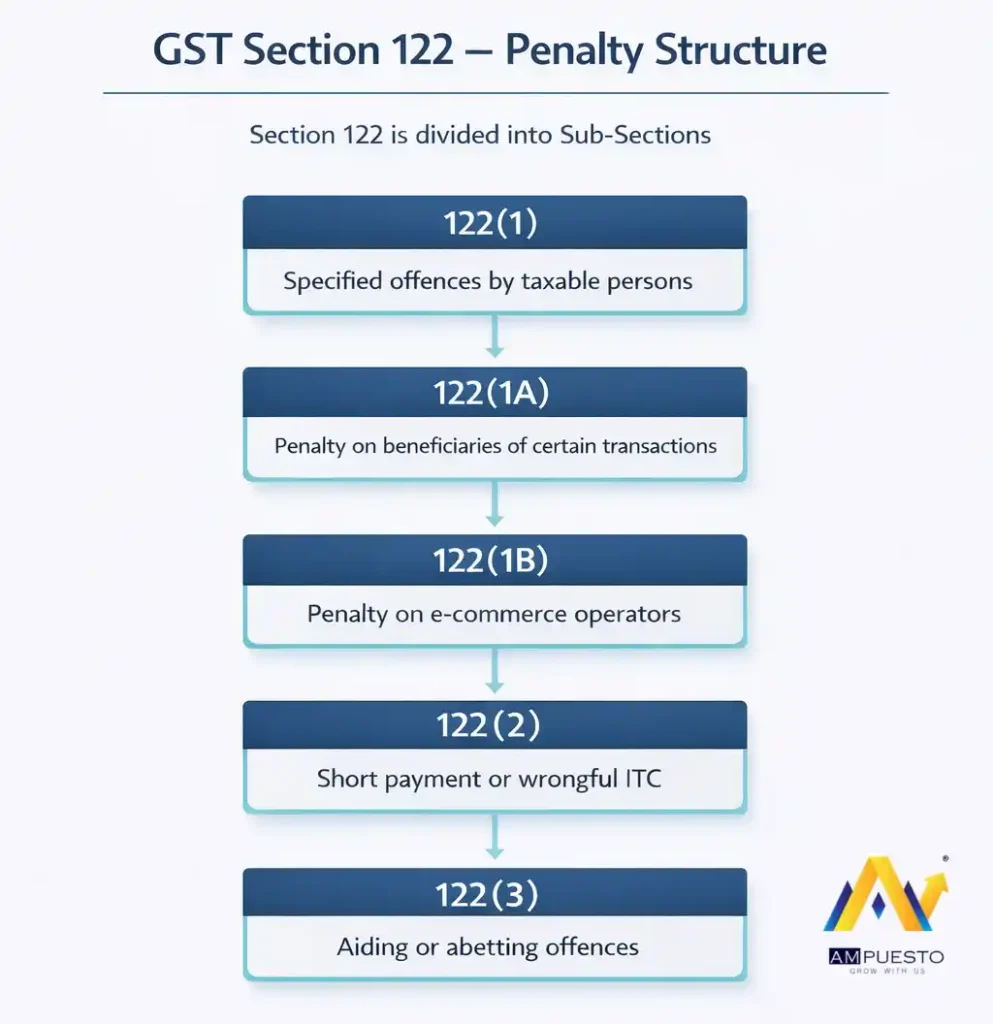

Section 122 is divided into Sub-Sections:

- 122(1) – Specified offences by taxable persons

- 122(1A) – Penalty on beneficiaries of certain transactions

- 122(1B) – Penalty on e-commerce operators

- 122(2) – Short payment or wrongful ITC

- 122(3) – Aiding or abetting offences

Each operates independently.

Section 122(1): Core Penalty Provision

Applicability

- Registered persons

- Persons liable for registration, but who failed to obtain it

Penalty Amount

Higher of:

- ₹10,000, or

- The amount of tax involved

Even if the tax impact is minimal, the minimum statutory penalty is ₹10,000.

Complete List of Offences Covered Under Section 122(1)

Penalty under Section 122(1) applies if a taxable person:

1. Supplies goods or services without issuing a tax invoice or issues false or incorrect invoices.

2. Issues an invoice without the actual supply of goods or services.

3. Collects any amount as tax but fails to deposit it with the government beyond a period of three months from the date on which such payment becomes due.

4. Collects GST but fails to deposit it with the government beyond a period of three months from the date on which such payment becomes due.

5. Fails to deduct the tax (TDS) or deducts an amount which is less than the amount required to be deducted, or where he fails to pay to the Government, the amount deducted as tax.

6. Fails to collect tax (TCS) or collects an amount which is less than the amount required to be collected, or where he fails to pay to the Government the amount collected as tax.

7. Takes or utilises input tax credit without actual receipt of goods or services or both, either fully or partially, in contravention of the Act.

8. Fraudulently obtains a refund of tax.

9. Takes or distributes input tax credit in contravention of section 20 (Input Service Distributor).

10. Falsifies or substitutes financial records or produces fake accounts or documents or furnishes any false information, or returns with an intention to evade payment of tax due under this Act.

11. Fails to obtain GST registration despite being liable.

12. Furnishes false information at the time of applying for GST registration.

13. Suppresses turnover or sales.

14. Fails to keep, maintain, or retain (till the expiry of 72 months from the due date of furnishing of annual return) proper books of accounts and documents.

15. Fails to furnish the required information or documents called for by an officer or furnishes false information or documents.

16. Supplies, transports, or stores any goods which he has reasons to believe are liable to confiscation under this Act.

17. Issues any invoice or document by using the registration number of another registered person.

18. Disposes of or tampers with any goods that have been detained, seized, or attached under this Act.

19. Obstructs or prevents any GST officers during inspection or audit.

20. Transports goods without a valid document or e-way bill.

21. Tampers with or destroys any material evidence or documents.

Applicability of Section 122(1A)

Section 122(1A) applies to:

- Any person who retains the benefit of a transaction covered under clauses (i), (ii), (vii), or (ix) of sub-section (1), and

- At whose instance is such a transaction conducted?

Penalty:

Such a person shall be liable to a penalty of:

- An amount equivalent to the tax evaded; or

- An amount equivalent to the input tax credit availed or passed on.

Applicability of Section 122(1B)

Section 122(1B) applies to:

- Any electronic commerce operator (ECO) who is liable to collect tax at source under Section 52;

- If such an operator allows the supply of goods or services or both through its platform by an unregistered person (other than a person exempted from registration under this Act).

Penalty:

In such cases, the ECO shall be liable to a penalty of:

- ₹10,000; or

- The amount of tax involved,

Whichever is higher.

Applicability of Section 122(2)

Section 122(2) applies to:

- A registered person.

Penalty:

Penalty applies where such a person:

- Supplies any goods or services or both on which tax has not been paid, has been short-paid, or has been erroneously refunded; or

- Has wrongly availed or utilised input tax credit.

Reason for the Default

1. Where the case does not involve fraud, wilful misstatement, or suppression of facts to evade tax:

Penalty amount:

- ₹10,000; or

- Ten per cent of the tax due from such a person,

Whichever is higher.

2. Where the case involves fraud, wilful misstatement, or suppression of facts to evade tax:

Penalty amount:

- ₹10,000; or

- The tax due from such person,

Whichever is higher.

Section 122(3) – Penalty for Aiding or Abetting GST Offence

Section 122(3) applies to any person, even if not registered under GST.

A person shall be liable to a penalty if he:

- Aids or abets any of the offences specified in sub-section (1);

- Acquires or deals with goods liable to confiscation;

- Receives benefits from fake invoicing.

- Fails to appear before GST authorities when summoned;

- Fails to issue an invoice as required.

Penalty Amount

- Liable to an amount which may extend up to ₹25,000.

Practical Examples of Section 122

Example 1: A taxpayer collects GST from customers but does not deposit it. Penalty under Section 122 applies along with tax and interest.

Example 2: A firm claims ITC without receipt of goods. This is treated as ineligible ITC, and a penalty is imposed.

Example 3: A business crosses the turnover limit but delays GST registration. Section 122 penalty becomes applicable.

How to Avoid Section 122 Penalties

1. Issue valid tax invoices for every taxable supply.

2. Deposit collected GST within the due dates.

3. Reconcile ITC with GSTR-2B monthly.

4. Maintain statutory books for 72 months.

5. Ensure registration accuracy.

6. Respond promptly to departmental notices.

Final Takeaway

Section 122 is strict but structured. The offences are clearly listed. The penalty framework is formula-driven. Liability largely depends on documentation, timing, and intent.

If businesses maintain disciplined compliance systems, reconcile ITC regularly, and respond proactively to notices, exposure under Section 122 can be substantially minimized.

Understanding this section is not just about avoiding penalties. It’s about building a defensible GST compliance architecture.

FAQs

No. Penalty is imposed through adjudication proceedings. A show cause notice and opportunity of hearing are mandatory.

In certain cases under Section 73, reduced penalty benefits are available if tax and interest are paid within the prescribed timelines.

Yes. Many procedural violations attract a penalty even without fraud. However, quantum differs from fraud cases under Section 74.

No. Payment of tax and interest does not automatically extinguish penalty liability unless specifically provided under settlement provisions.

The Section 122 penalty notice does not have a standalone time limit but must generally be issued within the 3-year or 5-year limitation periods prescribed under Sections 73 or 74 (or 42 months under Section 74A for newer periods) of the CGST Act.